that much The fintech industry is developing rapidly and disrupting the traditional financial system. This article provides the latest research insights to help you stay ahead and understand the future of financial technology. Enjoy your research!

The Department provides insight into the applicable (transitional) legislation following the breakdown of the zoning plan (Stibbe).

A recent ruling from the Cabinet Committee clarifies the legal framework for decisions after January 1, 2024, in the aftermath of the cancellation of the zoning plan. In the baseline scenario, environmental laws must apply to new decisions, but exceptions exist where existing laws may still apply. This ruling provides important guidance to municipalities grappling with post-invalidation spatial planning and provides clarity on the legal parameters within which decisions must be made. By outlining these parameters, the ruling seeks to promote legal certainty and informed decision-making among local councils, ensure compliance with the relevant legal framework and promote effective land use management and development. read more

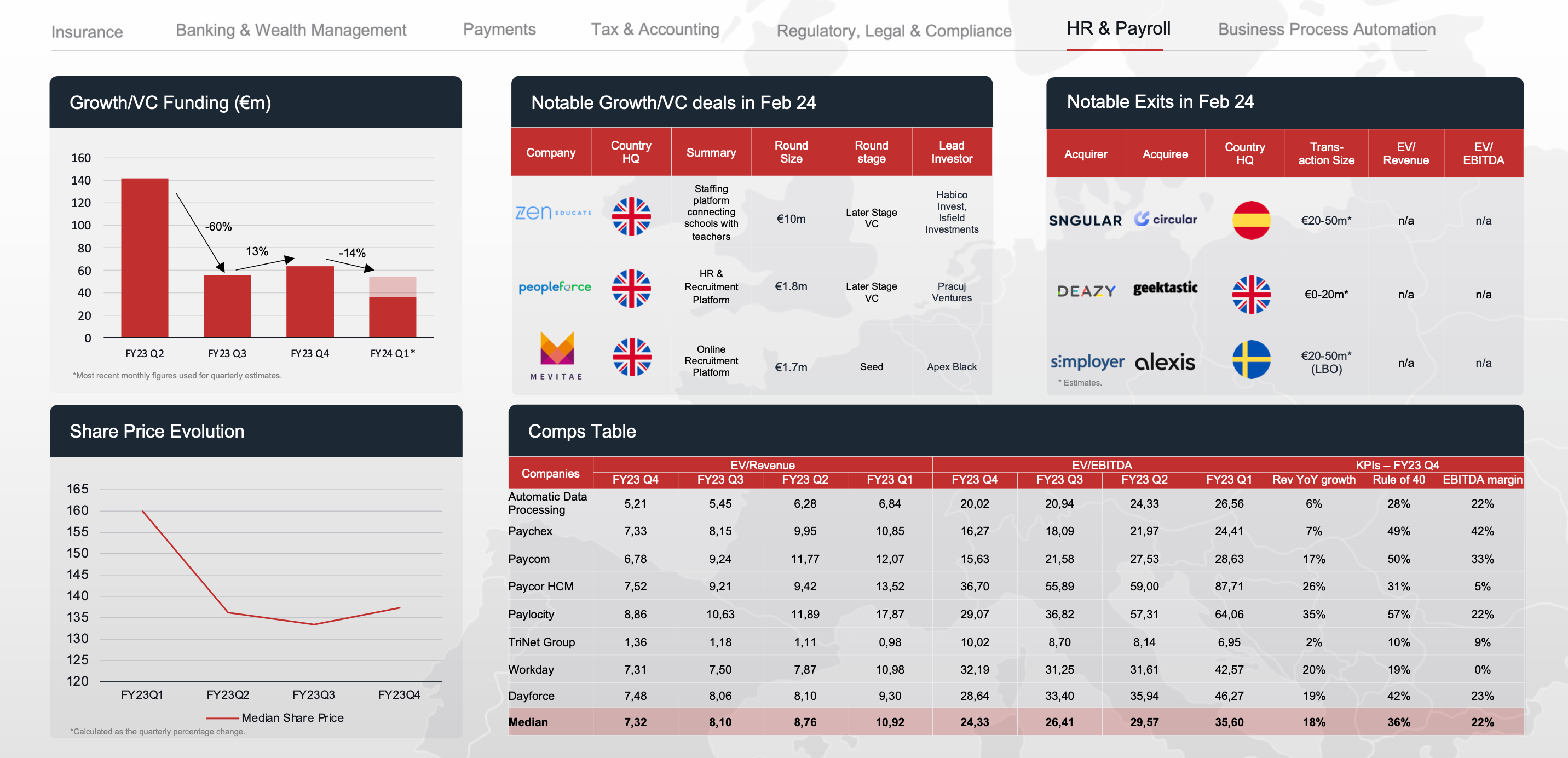

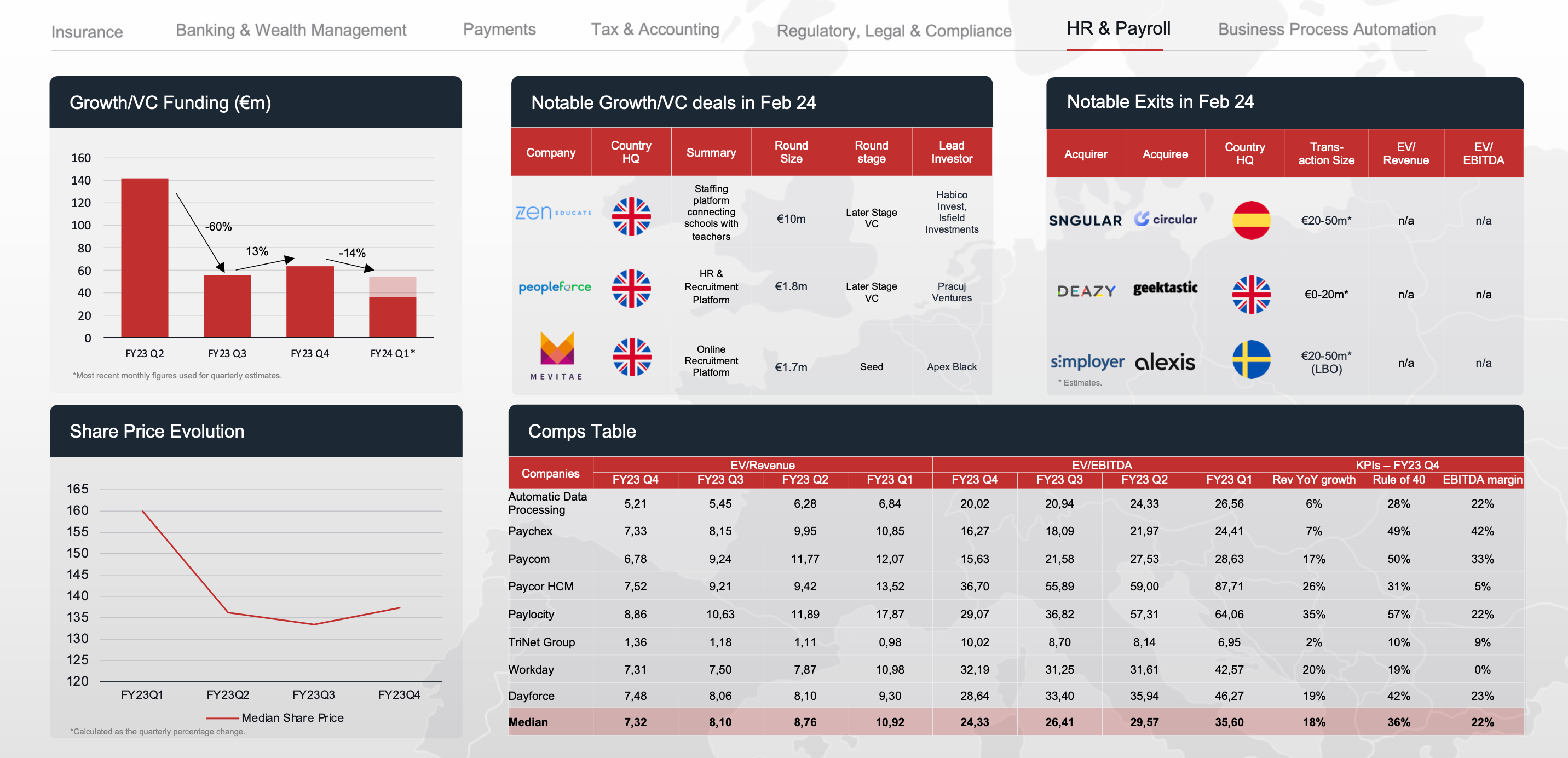

Finch Capital Market Pulse – March Edition (Finch Capital)

The March issue of Finch Capital’s monthly Market Pulse focuses on seven key topics across finance and business technology: Insurance, Banking & Wealth Management, Payments, Tax & Accounting, Regulation, Legal & Compliance, HR & Payroll, and Business Process Automation. is leaving. In this report, we analyzed recent trends and performance for each theme. We highlight Europe’s top M&A and financing deals and examine the financial performance of public companies within each key topic, providing insight into the current industry environment. Readers can learn more by downloading a copy of Market Pulse. read more

2024 Q1 Venture Status Report (CBInsights)

The venture capital landscape experienced mixed trends in the first quarter of 2024. Total funding saw a slight rebound of 11% quarter-over-quarter, but transaction volume declined for the eighth consecutive quarter. Mega rounds, particularly in the generative AI space, accounted for a significant portion of the funds, indicating continued interest in blockbuster deals. Despite the emergence of 19 new unicorns globally, fintech funding fell 16%, while digital health and retail technology increased. Silicon Valley remains the dominant hub of VC activity, accounting for 42% of U.S. funding. While there has been some upside to funding overall, challenges persist in deal size and sector performance, reflecting the complex dynamics of the venture capital market in the first quarter of 2024. listen more

–

Have news to share? Please add Feed@hollandfintech.com to your press list.

Want to read and learn more about fintech? Then subscribe and read the full newsletter here. For other weekly highlights, check out these links: Analysis and Opinion