Bitcoin and altcoins are likely to see a bullish trend as cryptocurrency investors start depositing stablecoins on centralized exchanges.

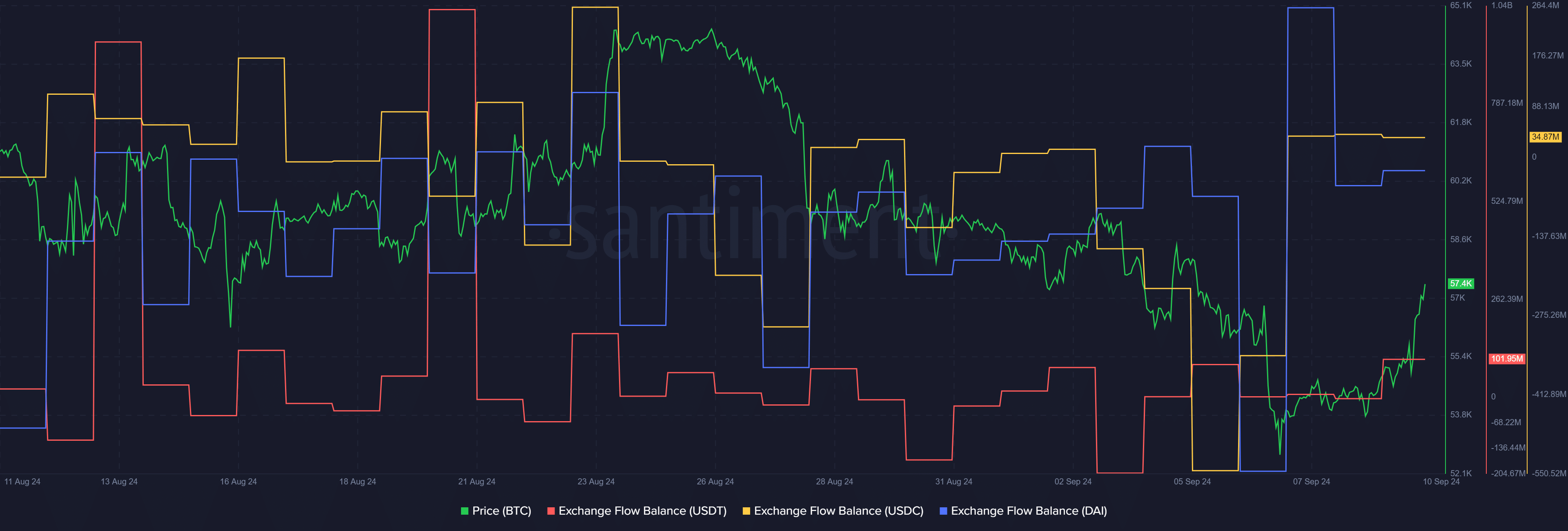

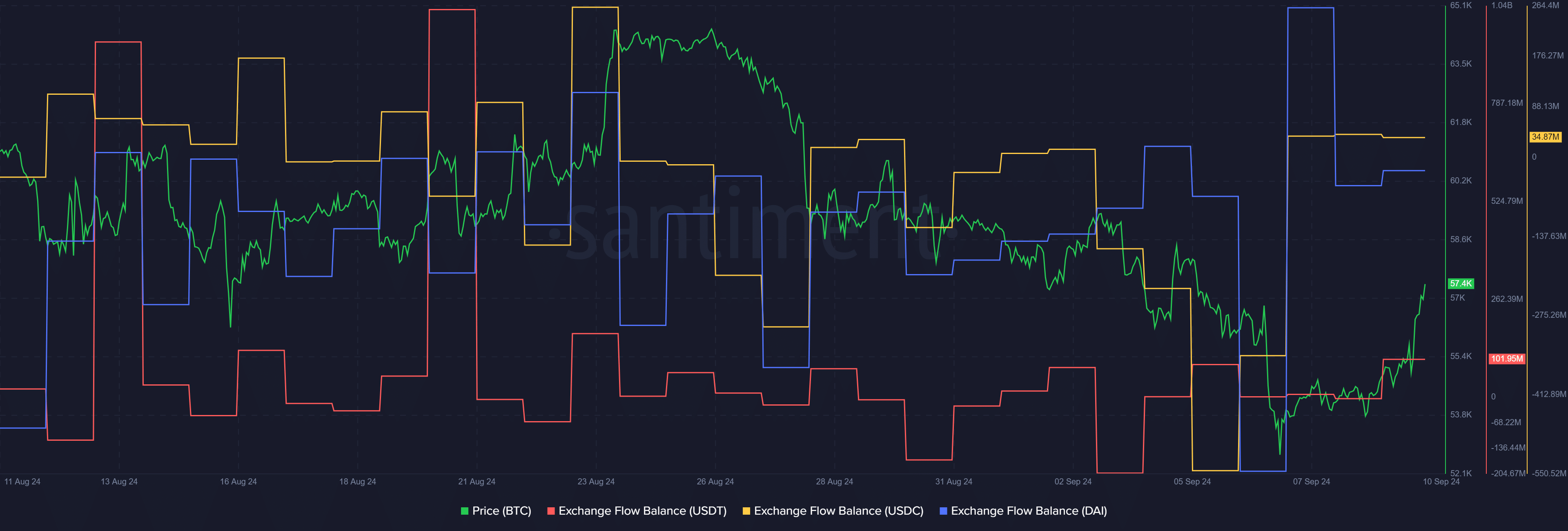

According to data provided by Santiment, the total net exchange inflow of the top three stablecoins (Tether (USDT), USD Coin (USDC), and Dai (DAI)) reached $141.2 million in the last 24 hours.

According to Santiment data, USDT alone recorded a net inflow of $101.95 million, followed by USDC with $34.87 million. DAI, the third-largest stablecoin by market cap, recorded a net inflow of $4.24 million on exchanges.

The surge in net flows on stablecoin exchanges shows increasing buyer optimism.

In addition, the cryptocurrency market showed a similar movement on August 22, with the Bitcoin price breaking through $64,000, and the global cryptocurrency market capitalization reaching a domestic high of $2.36 trillion.

According to CoinGecko data, the global cryptocurrency market size has soared to $2.9 trillion, while the stablecoin market size is currently at $170.9 billion. Daily trading volume in this category has also surpassed $60 billion, following the bullish momentum.

Bitcoin (BTC) is up 3.8% over the last 24 hours and is trading at $57,250 at the time of writing. According to a report by crypto.news, whales have started accumulating BTC and are sending the assets to their own custodial wallets.

One of the main reasons behind the bullish momentum across the market is the release of the US Consumer Price Index report for August, which shows the US inflation rate for August.

It is worth noting that if inflation were to rise above the expected 2.6%, the market would likely move in the opposite direction.