Defi exchange Uniswap has been warned of impending enforcement action by the US SEC.

On April 10, Uniswap published the Wells Notice issued by the SEC’s Division of Enforcement. The notice is part of a broader crackdown on cryptocurrencies by the securities watchdog, with Chairman Gary Gensler arguing that most digital assets issued on blockchains are subject to existing financial laws.

Gensler often refers to cryptocurrencies as the “Wild West” and has been trying to dominate the industry through enforcement actions.

Uniswap founder’s reaction

Uniswap founder and CEO Hayden Adams wrote to X that he was annoyed and disappointed but was ready to fight the SEC and protect the company.

In a blog post discussing the SEC’s notice, Uniswap also refuted the claim that most cryptocurrencies constitute investment contracts. Like many players in the industry, including Coinbase, DEX has claimed that the overwhelming amount of tokens traded are stablecoins, utility tokens, and commodities such as Bitcoin (BTC) and Ethereum (ETH).

“Despite the SEC’s rhetoric that most tokens are securities, the reality is that tokens are digital file formats, such as PDFs or spreadsheets, and can store many different kinds of value. They are not securities per se, any more than all paper is a stock certificate. We are confident that the products we offer are not only legal but also innovative.”

Uniswap’s April 10 blog post

According to DefiLlama, Uniswap is the largest DeFi exchange, with a total value of over $6.2 billion across 16 individual blockchains. According to CoinGecko data, DEXs handle 22.5% of all cryptocurrency trading volume.

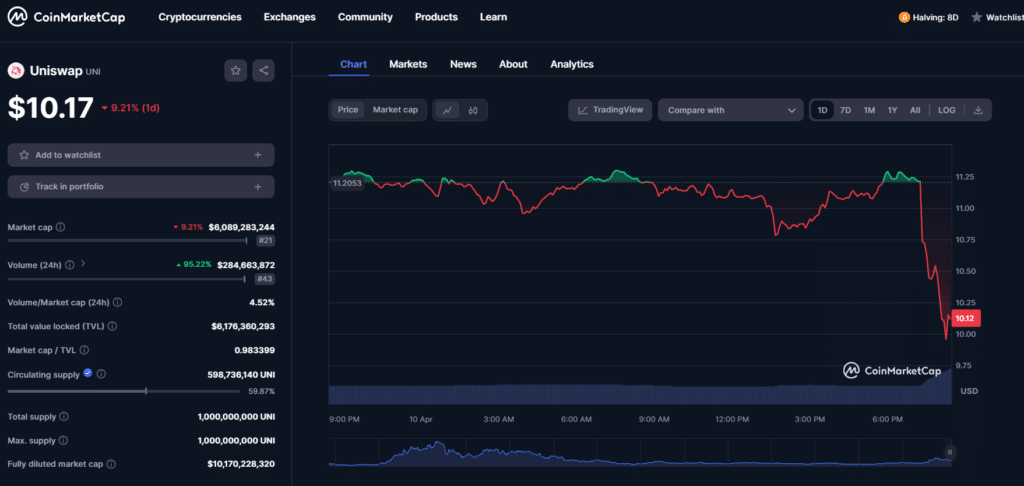

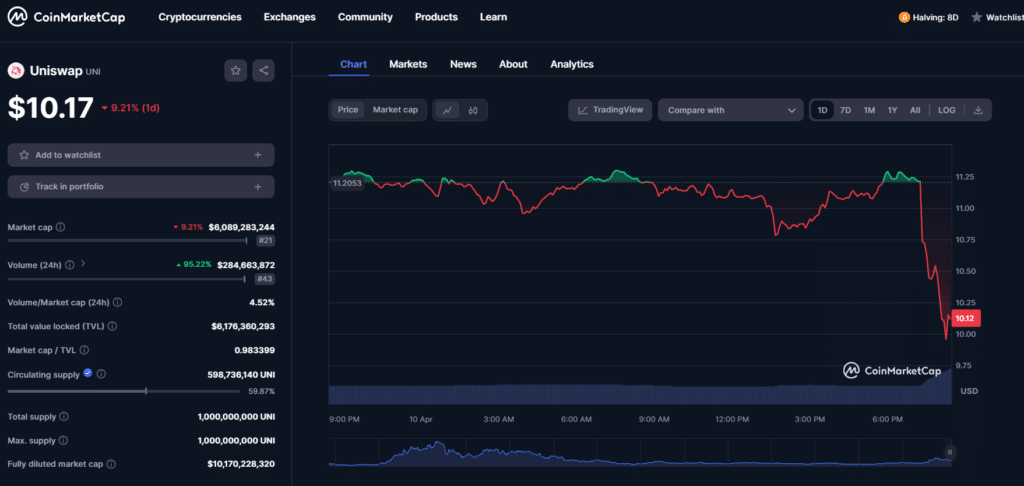

Following this news, the UNI token fell more than 9% and was trading at around $10, per CoinMarketCap.