Ethena is a project developed to solve the problems of existing stablecoins in the cryptocurrency market.

What is Ethena (ENA)?

Athena It is a cutting-edge decentralized finance (DeFi) protocol built on the Ethereum blockchain. It is designed to create a synthetic dollar, a digital asset that maintains price parity with the United States dollar (USDe).

The ENA token is the native governance token of the Ethena protocol. Ethena uses smart contracts to allow users to mint, trade, and exchange synthetic dollars without the need for a central authority or intermediary. This gives users greater control over their funds and financial transactions.

ENA tokens play an important role in the governance and operation of the Ethena protocol. Token holders have voting rights in the protocol’s decision-making processes, such as proposing changes and voting on protocol parameters or upgrades.

You can also stake ENA tokens to receive rewards in the form of transaction fees generated by the protocol. This encourages token holders to actively participate in the protocol, contributing to its security and stability.

Overall, Ethena aims to revolutionize the way decentralized finance operates by providing a stable and transparent platform for users to access synthetic dollars and participate in protocol governance.

Why is Ethena Labs important?

Ethena provides critical solutions to the growing DeFi sector. Synthetic dollars play an important role in a variety of DeFi applications, including:

- Stablecoins for trading: We provide traders with assets with stable prices for cryptocurrency trading in the highly volatile cryptocurrency market.

- Loans and Borrowing: Users can lend and borrow assets at a stable value.

- Yield Generation: Users can earn returns on their cryptocurrency holdings with less risk compared to other cryptocurrency assets.

How does the Ethena protocol work?

Ethena maintains collateral pools of cryptocurrency assets, primarily Ethereum. Users can deposit collateral to mint synthetic dollars. The protocol uses a complex algorithm and incentive system to maintain the price stability of the synthetic dollar. ENA token holders participate in governance decisions and help shape the future of the protocol.

Should I invest in Ethena (ENA) tokens?

Deciding whether or not to put money into ENA is a personal choice. It is important to research Ethena Labs extensively, including the protocol, token economics, team, and roadmap. Consider your risk tolerance and overall investment approach. Investments in Ethena (ENA) tokens should be evaluated carefully.

Here are some pros and cons to help you make an informed decision.

Benefits of Ethena:

- impressive idea

- Effective Vesting Plan

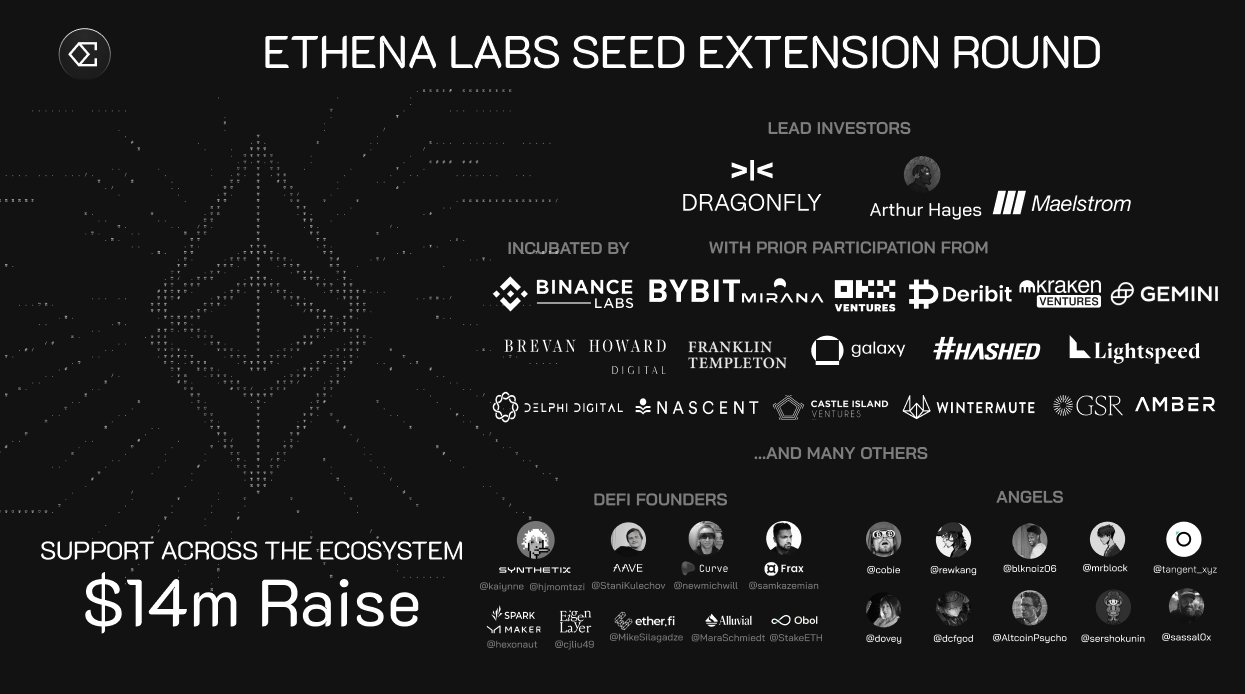

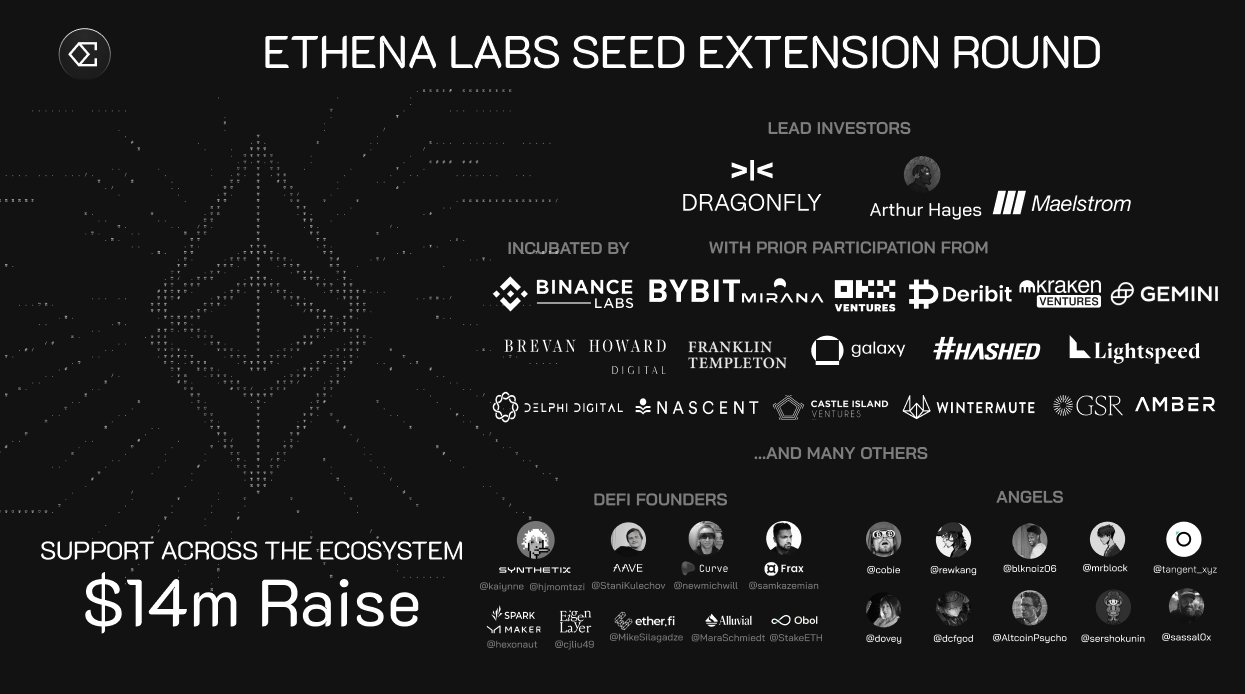

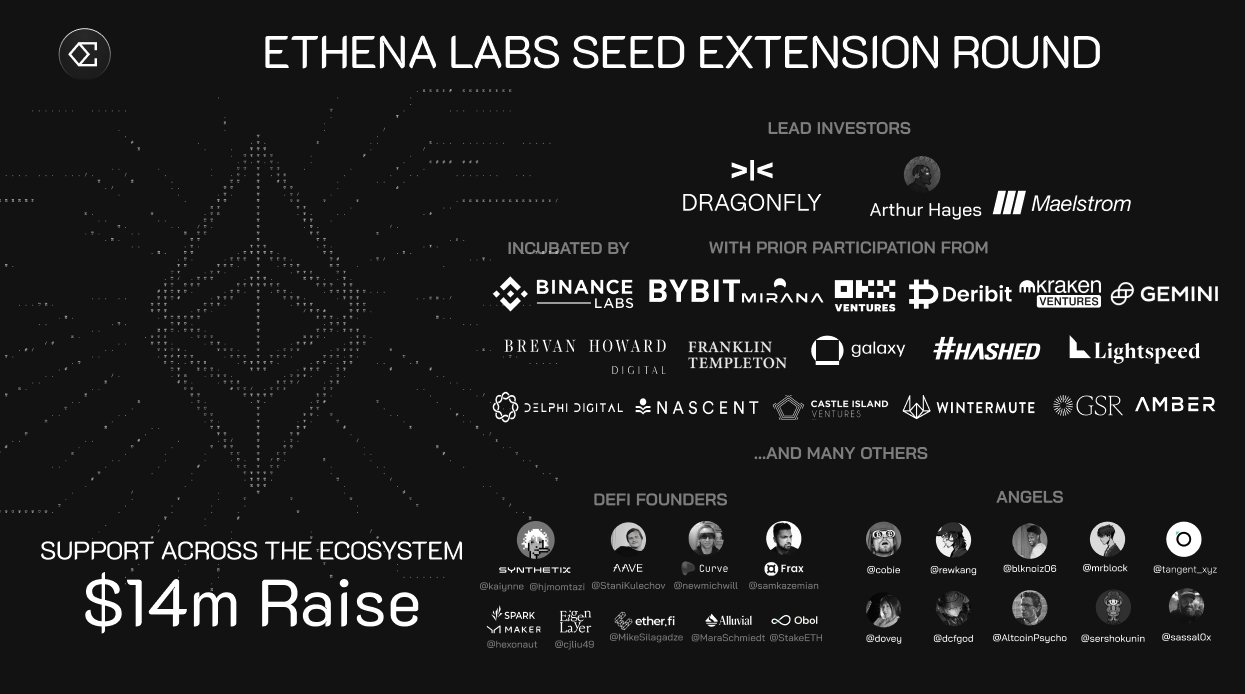

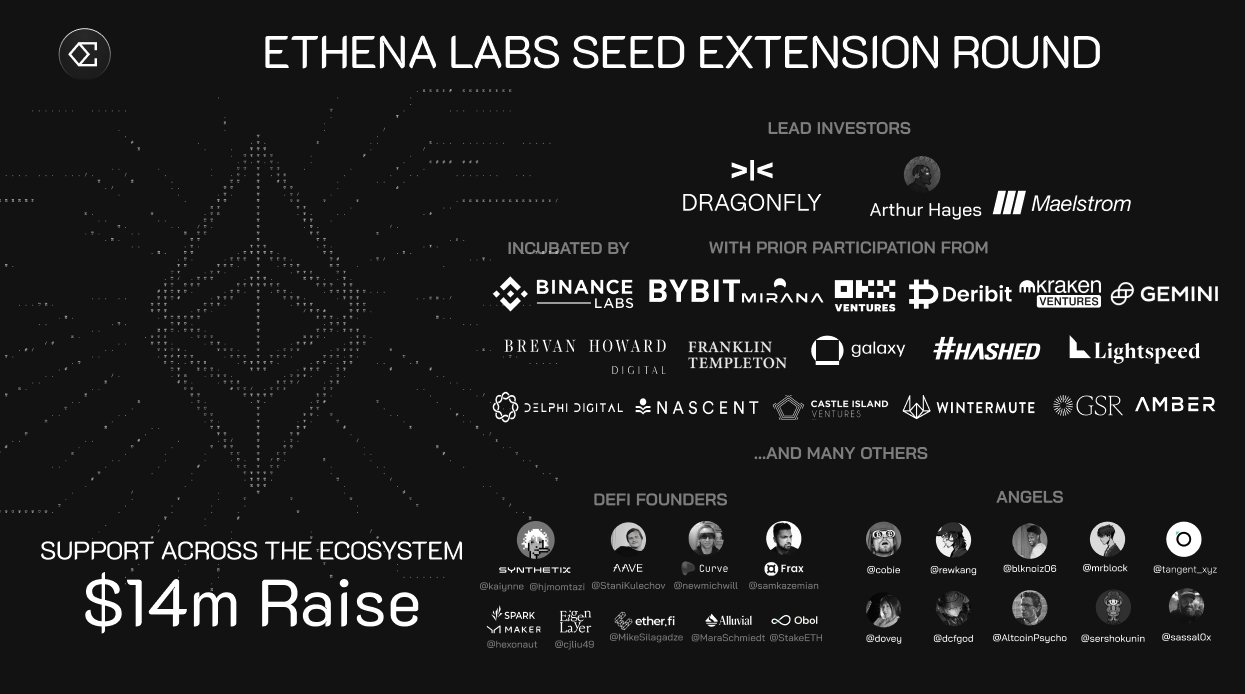

- Backed by top level funding

- Extensive network of top partners

- Successful promotional and growth marketing activities

- Effective influencer marketing campaigns

- We have gone through several security audits and bug bounty programs from reputable companies.

- Relatively low initial market capitalization/fully diluted valuation (FDV) ratio (9.5%)

- Experienced Management

| token name | Athena |

| ticker | this one |

| blockchain | Ethereum |

| token standard | ERC-20 |

| contract | to update |

| token type | rule |

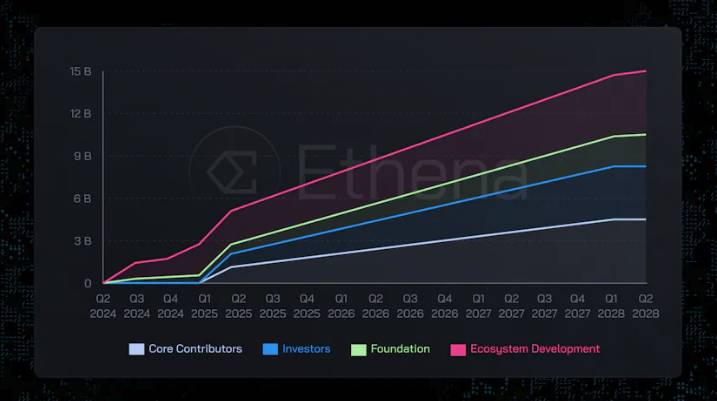

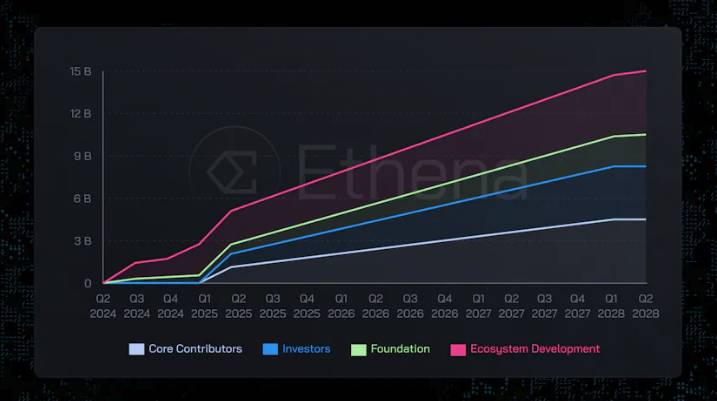

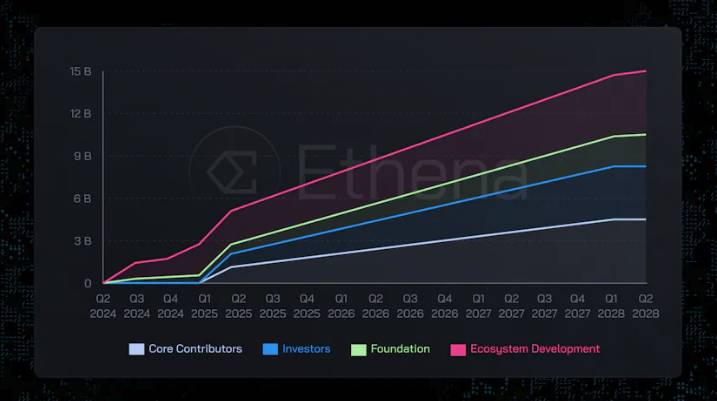

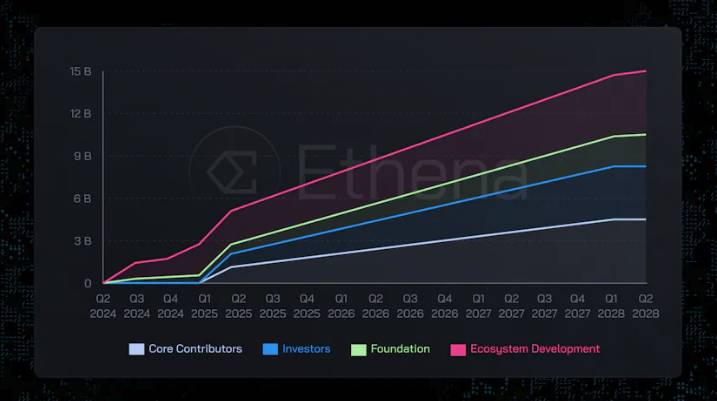

| total supply | 15,000,000,000 |

| circulating supply | to update |

Disadvantages of Ethena:

- Because the protocol is complex, there are significant risks associated with it. delta hedging draw close.

- Defamation caused by the failure of Terrana Luna.

It is important to note that investing in any cryptocurrency carries inherent risk, and it is important to conduct thorough research and consider your own risk tolerance before making any investment decisions.

What is delta hedging?

Delta-hedging, also known as delta-neutral trading strategy, is used to generate profits when there is no direction in the market. Although this is a definition, there are countless ways to apply it in practice, the common goal of which is to eliminate price volatility and generate profits.

This means that your position will not change even during market fluctuations. When applied to the cryptocurrency market, the most commonly used investment methods are to balance the user’s portfolio to zero, create hedges, and earn profits through other methods such as IDO, Airdrop, Staking, Farming, etc.

conclusion

Athena This project to issue a stablecoin based on delta-neutral investment method is currently attracting great attention from the investor community. Coinbold provides general information only and does not constitute investment advice.