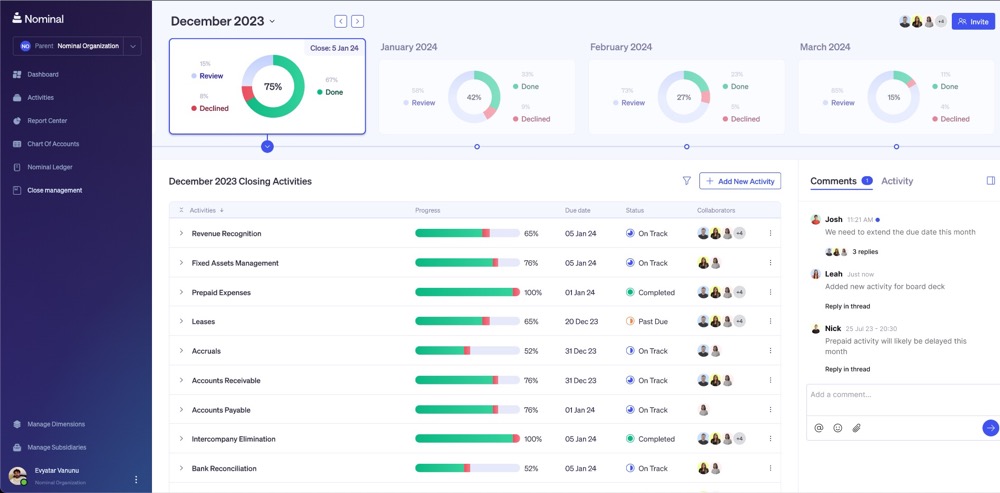

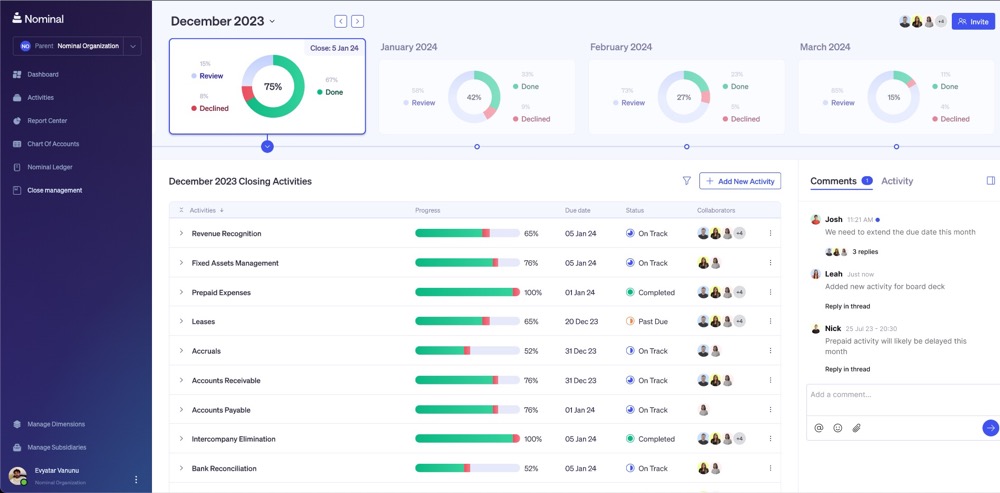

Enterprise resource planning (ERP) systems are at the heart of many companies, centralizing core business processes across the organization, handling a variety of functions such as finance HR, supply chain, inventory, service, procurement, and more. However, legacy ERP products, many of which were designed in the early 2000s, are starting to show signs of obsolescence and are unable to keep up with the complex needs of today’s businesses. nominal You want to modernize your ERP system with a platform that uses generative AI to translate business logic into accounting workflows. The platform creates a shadow ledger that can be implemented quickly without disrupting existing systems or migrations. This shadow ledger can be used to handle the financial management needs of multi-entity businesses, simplifying tasks such as consolidated statement development, reporting, revenue recognition, and even more. Customized items. While integrating with your company’s entire financial stack, Nominal serves as a unified workspace that syncs and updates in real time. At launch, the company is focused on targeting mid-market, multi-enterprise companies across real estate, energy and technology, as well as holding companies.

Alley surveillance We caught up with Nominal co-founder and CEO. Guy Leibovitz To learn more about the business, the company’s strategic plan, recent funding, and more…

Who were your investors and how much did you raise?

We are pleased to announce that we have raised $9.2 million in seed funding led by: bling capital and Hyperwise VenturesWith the participation of Bella Partners, Incubate Fund, There are executives from well-known companies such as Bill.com, Salesforce, Justworks, and ServiceNow. This funding will allow us to accelerate our product offering, expand our market reach, and increase our sales and support resources.

Please tell us about the products or services that Nominal offers.

Nominal is leveraging generative AI to bridge the gap between outdated, costly ERP systems and the financial management needs of modern mid-market, multi-entity enterprises.

The $44 billion ERP market (Gartner 2023), originally revolutionized by the cloud, now grapples with outdated systems that require costly engineering to meet the needs of modern enterprises. Nominal believes generative AI is a pivotal technology, especially considering the decline in CPA candidates and the proliferation of finance and accounting point solutions. Compared to traditional search-based assistants like SAP Joule and Sage Copilot, Nominal takes a proactive approach, transforming business logic into automated accounting workflows.

The company plans to use the funds to accelerate its product offering, expand its market reach, and increase its sales and support resources in the United States. The companies primarily include holding companies, real estate, energy, and multinational technology companies in their initial market entry plans.

What prompted you to start Nominal?

How are nominals different?

Nominal’s AI-based platform differs in several key ways: First, shadow ledgers extend existing ERP and general ledger without migration, minimizing risk and disruption to current operations. Second, generative subledgers transform various data inputs and business logic into automated workflows, streamlining processes such as multi-entity integration and management, lease accounting, and revenue recognition. Third, our platform provides customized workflows that allow businesses to tailor their financial operations to their specific needs. Finally, our period-end collaboration tools and advanced reporting capabilities allow your finance team to focus on strategic growth rather than manual tasks.

What market is Nominal targeting and how big is it?

The current ERP market size is $44 billion.

What is your business model?

We are a pure Software-as-Service (SaaS) company and AI does the customization, so there is no competent service.

How are you preparing for a potential economic slowdown?

We believe that a recession could actually be beneficial to Nominal. In difficult economic times, companies are more reluctant to invest in costly and time-consuming ERP implementation projects. Interestingly, the previous wave of ERP adoption occurred in the early 2000s during the recession. Our AI-based solutions provide a more cost-effective and efficient alternative, allowing businesses to modernize their financial management processes without significant capital investments or disruption to existing systems.

How was the funding process?

We were lucky during the funding process because we had already built a relationship with a following. Kyle Louis Bling Capital and Nathan Shchami From Hyperwise Ventures. We have known them for some time and were keen to collaborate with them due to their expertise and shared vision for Nominal’s potential.

What are the biggest challenges you face while raising capital?

One of the key challenges we faced while raising capital was that many VCs recognized the challenges, market opportunity and large TAM in the ERP space. But some investors initially thought building the solution would be too difficult and capital-intensive. Despite these concerns, our early market traction has provided strong indications that our approach is not only feasible, but also delivers significant value to our target customers.

What is it about your business that causes your investors to write a check?

I believe several factors influenced investors’ decision to invest in Nominal. Many VCs are well aware of the complexities and challenges associated with implementing traditional ERP systems. They recognize the significant market opportunity and the need for more modern AI-based solutions. Additionally, the fact that our founding team had previously successfully navigated this space following NetApp’s acquisition of our predecessor company, Cognigo, should have instilled confidence in our ability to execute on our vision and deliver value to our customers.

What milestones do you hope to achieve in the next six months?

Over the next six months, we plan to achieve several important milestones. We will focus on expanding the capabilities of our platform by introducing new AI-based workflows. We also aim to accelerate our market expansion efforts within the mid-market segment, targeting a variety of industries where our solutions can deliver significant value. We’ll also collect feedback, measure impact, and prioritize customer success initiatives to ensure our customers achieve their desired outcomes. Finally, we plan to establish strategic partnerships with complementary technology providers and system integrators to expand our ecosystem and provide more comprehensive and integrated solutions to our customers.

What advice can you give to businesses in New York that are not seeing new capital flowing into their banks?

My advice is to maintain a low burn rate and focus on prioritizing initiatives with the greatest potential to generate revenue and drive growth. One effective approach is to pursue multi-year deals with built-in expansion opportunities. This can provide a more stable and predictable revenue stream.

Where do you see the company going in the short term?

In the near term, Nominal is expected to build on its success in the mid-market segment and expand its offerings into adjacent markets. We will leverage our AI-based platform and insights gained from our current customers to identify new opportunities to address the financial management needs of companies across the sector. This expansion will allow us to generate additional revenue streams, diversify our customer base, and further establish Nominal as a leading provider of accounting automation solutions.

What is your favorite restaurant in this city?

I have to say hello to Pharos of Tribeca. Not only do they serve amazing Greek cuisine, but their Lychee Green-Tini cocktail is also a must-try.