According to QCP Capital, the cryptocurrency market liquidation on Friday was primarily triggered by growing concerns about the conflict between Iran and Israel.

Historically, geopolitical instability has tended to push investors away from risky assets like cryptocurrencies and seek safety in more stable investments.

These changes often result in selling across risky asset classes, as observed in recent recessions.

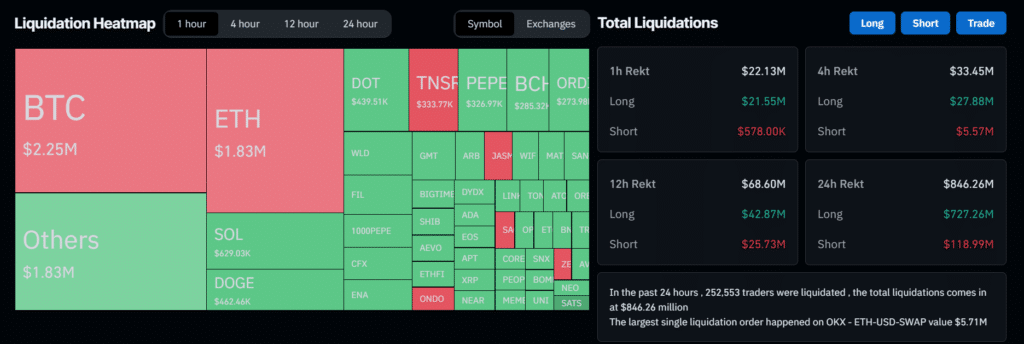

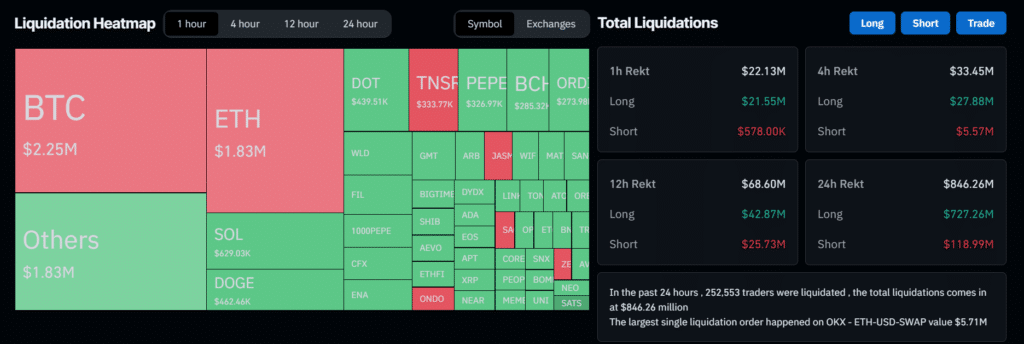

In the last 24 hours, 261,054 traders were affected and $860.82 million in assets were liquidated as the overall cryptocurrency market cap plummeted nearly 5%.

QCP Capital also observed that the ETH risk reversal indicator plays an important role in liquidations. The company noted on Friday that there was a noticeable downward skew in Ethereum risk reversal, suggesting a potential decline.

The bearish skewness of the risk reversal indicates that traders are betting on a decline in the price of ETH, which is likely caused by using ETH as a hedge.

This technical indicator has proven to be accurate, with the value of ETH falling by more than 5% to $3100. Speculators with long positions in altcoins typically use ETH put options to protect against economic downturns, making the price of ETH particularly sensitive to changes in market sentiment.

The fear prevalent in the cryptocurrency market was further reflected in negative movements in perpetual swap funding rates.

The rate plunged above -40%, marking the largest negative financing this year and signaling strong bearish sentiment.

This anxiety has also caused the forward curve to collapse, with the front end falling below 10%, highlighting the bleak near-term outlook for cryptocurrency prices.