Posted by Fintechnews Switzerland

April 12, 2024

Online marketplace lending continued to grow in Switzerland in 2022, driven by mortgage lending and corporate and public sector debt products.

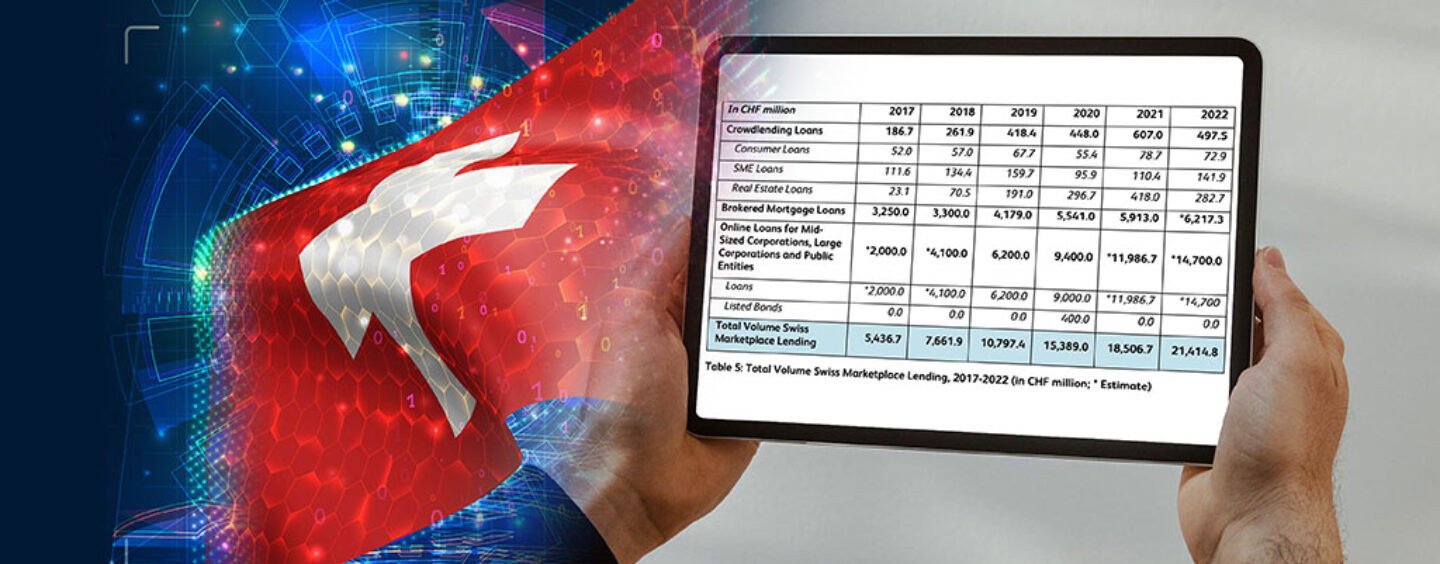

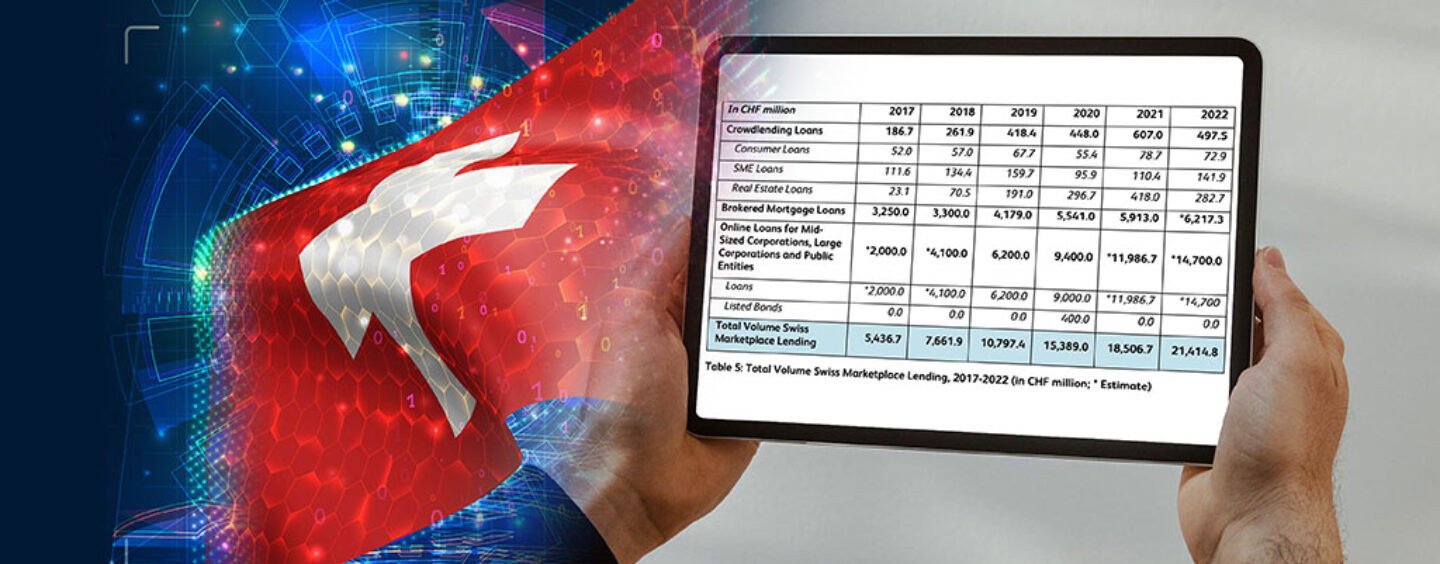

According to a study by the Lucerne School of Business and the Swiss Marketplace Lending Association (SMLA), the total volume of debt capital issued on online platforms reached a new record of 21.4 billion Swiss francs in 2022, up 15.7% compared to the previous year. yo. this). Much of this growth was driven by increases in online mortgage lending and corporate and public debt financing, which increased 5% and 22.6% year-on-year, respectively.

According to data shared in the latest edition of the Marketplace Lending Report Switzerland, the economic importance of digital lending continued to increase in the Swiss market in 2022, with loan volumes for corporate and public entity debt and mortgage lending rising. You can see that the trend is continuing. Online lending to medium and large businesses and public institutions surged from around CHF 2 billion in 2017 to CHF 14.7 billion in 2022, while brokered mortgage lending increased from CHF 3.3 billion to CHF 6.2. 10 billion.

Overall, the total amount of debt capital issued on online platforms increased nearly four-fold between 2017 and 2022, growing at an average annual growth rate of approximately 32%.

Total Swiss Marketplace Lending Volume, 2017-2022, Source: Marketplace Lending Report Switzerland 2023, Lucerne School of Business and Swiss Marketplace Lending Association, October 2023.

Online crowd lending fell 18% in 2022 compared to the previous year, while online mortgages and corporate and public sector debt continued to rise. This decline was primarily driven by a somewhat more modest decline in the number of real estate loan transactions (-32.4%). , consumer lending decreased (-7%).

Switzerland’s marketplace lending ecosystem

By the end of 2022, Switzerland had 29 own marketplace lending platforms, with crowd lending being the most crowded sector, comprising 14 platforms. These platforms connect individual and/or institutional investors with consumers and/or businesses to provide debt. The third lending segment is real estate crowdlending, which provides mortgage-backed loans to individuals and small and medium-sized enterprises (SMEs).

A number of banks and insurance companies are participating in the Swiss crowdlending ecosystem, including PostFinance (Lendico), Vaudoise Group (Neocredit) and Luzerner Kantonalbank (Funders). Basellandschaftliche Kantonalbank is also a strategic stakeholder of Swisspeers.

Systemcredit, a marketplace that went online in 2018, is not included in the list of crowd lending platforms. Systemcredit offers small and medium-sized enterprises multiple credit offers from banks, institutional investors and crowd lenders, making its business mode similar to that of a broker.

Swiss Crowdlending Platform, Source: Marketplace Lending Report Switzerland 2023, Lucerne School of Business and Swiss Marketplace Lending Association, October 2023

Online mortgage lending was the second largest market lending segment in late 2022 and comprised 12 platforms. These platforms target individual borrowers with a professional investor base such as banks, insurance companies and pension funds as lenders, and allow part or all of the mortgage application process to be carried out online.

This category includes Atrium, a platform launched by UBS in 2017 (which eventually evolved into UBS Key4 Mortgages), and Valuu, launched by PostFinance in 2019. HypoPlus, Hypotheke and MoneyPark are independent mortgage lending platforms that are nonetheless connected to larger institutions. Fully independent mortgage brokerages in Switzerland include RealAdvisor, Resolve, topHypo, Hypohaus, PropertyCaptain and Hypo Advisors.

Although the online mortgage market is still a niche market, it has seen significant growth in volume, reaching a share of approximately 3.5% by the end of 2022, according to the report.

In the online corporate and public sector debt sector, two homegrown platforms were activated in Switzerland at the end of 2022. Operating since 2016, Loanboox has grown rapidly in the public sector lending market and is currently active in 12 European countries. nation. Cosmofunding is another platform operating in this sector. The platform, targeting public and corporate borrowers, is owned by Bank Vontobel and launched in 2018.

Lastly, in the money market sector, a single online platform was activated at the end of 2022. The platform is Instimatch Global and provides digital price discovery, negotiation, counterparty diversification and automated execution of money market products across multiple sectors and countries.

Market lending trends in Switzerland

The Swiss Market Lending 2023 report highlights the key trends observed in the Swiss Market Lending ecosystem in 2022, which are expected to continue to shape the trajectory of the industry.

One important trend is the growing emphasis on sustainability, as platforms begin to incorporate environmental considerations into their lending practices. Initiatives such as UBS Key4 Mortgages’ “green mortgages”, green scoring systems and sustainability-integrated decision-making processes are emerging, signaling a shift towards more environmentally conscious lending products. The marketplace lending platform is also addressing climate change by facilitating emissions reduction projects in Swiss municipalities.

Another trend described in the report is the development of the mortgage brokerage business. As growth rates begin to decline, the B2C sector is expected to see a slight slowdown or even decline in 2023 and 2024, triggering a shift towards the B2B sector.

Finally, another key trend is the role of market lending in financial innovation. These platforms, which leverage technologies such as artificial intelligence to increase efficiency and streamline loan evaluation, are contributing to the continued evolution of modern finance, the report said.

Main image source: edited from freepik