Before we begin learning about the mechanism involved in developing a P2P payment app like Cash App, we have some questions for you-

- How are you handling your finances these days?

- Are you still following the ancient ritual of queuing up at banks?

Probably, most of you might say ‘No’. We understand why your answer is no. Tech has evolved a lot. Whether you see it in the manufacturing industry or just the finance sector.

Fintech advancements have brought us a long way from traditional banking systems. We have digital portals, virtual banking assistants, and P2P payment apps that seem to be everyone’s new best friend.

Yes, we are talking about those handy apps like Cash App, Venmo, PayPal, and Zelle. Indulging fintech app development, businesses have unlocked a world where money transfers from one person to another are just a tap away. It is as easy as liking a photo on Instagram. Such convenience allows the digital payment market to boom.

How?

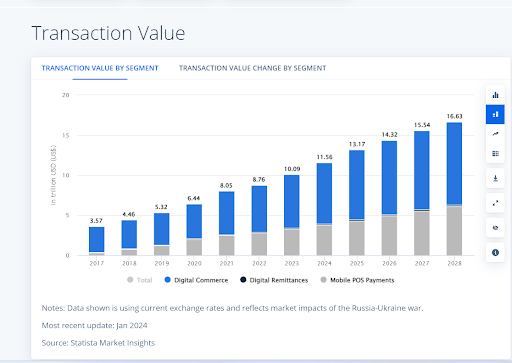

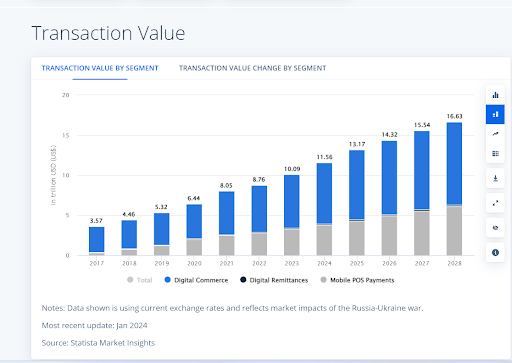

The graph below illustrates the increasing trend in the value of digital payment transactions over time. According to a report by Statista, the Digital Payments market is expected to achieve a total transaction value of US$11.55 trillion in 2024.

Image Source

Plus, according to a survey conducted by the American Bankers Association, consumers indicated a preference for managing their bank accounts through mobile apps rather than traditional methods.

| Method | Percentage |

| Mobile (apps on smartphone or tablet) | 48% |

| Internet/Online (Laptop or PC) | 23% |

| Branches | 9% |

| ATM | 8% |

| Telephone (calls to your bank) | 5% |

| 2% | |

| Don’t Know/no opinion | 5% |

With numbers like that, it’s no surprise that everyone wants a slice of digital finance.

So, if you’re an entrepreneur eyeing fintech app development guide, particularly the P2P payment apps sector, you might be asking yourself, How do I develop a P2P payment app like Cash App?

Well, lucky for you, you’re in the right place! We have shared everything that you need to know to develop such an app.

Let’s first get the basics clear-

What is a P2P Payment app?

P2P, or peer-to-peer payment apps, are digital platforms that allow individuals to transfer money from their bank account or credit card directly to another person’s account via the Internet.

Users have to do nothing more than a few taps on their smartphone screens to perform this sending and receiving of money. P2P payment apps have turned our phones into-

- Mobile wallets

- Digital piggy banks

- Personal finance assistants

Now, What is a Cash App?

Cash App, a mobile P2P payment service, was launched in 2009 by Jack Dorsey and Jim McKelvey. They claim that it is “the easiest way to send money” to contacts, friends, and family members all over the world.

It enables users to exchange money for their bank account or wallet and offers services in dealing with cost transfers, P2P trading, and cryptocurrencies.

Moreover, what made it popular in the P2P Payment app space is the interface of the application and the convenience it can give to the users. Cash App is available on Google Play and the Apple App Store.

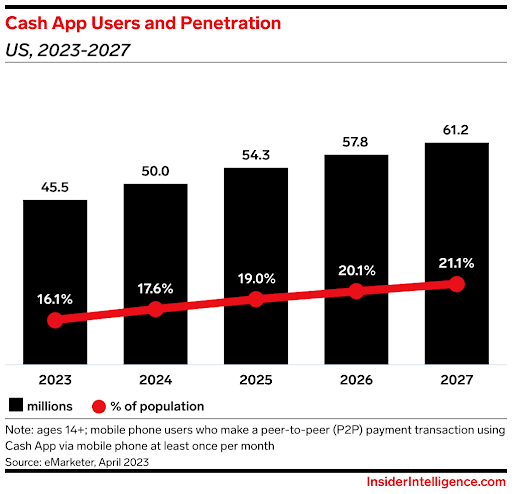

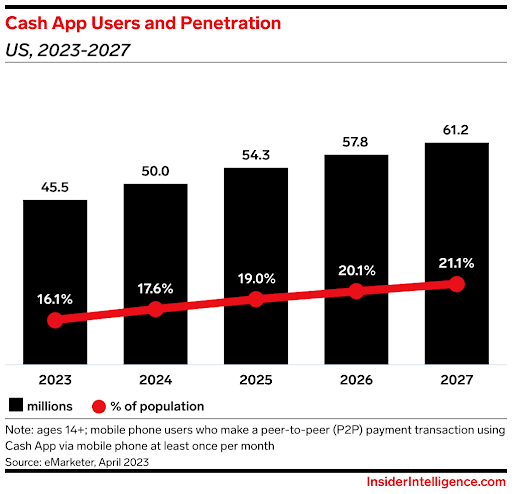

Statistics Related to Cash App

- The Cash App reported a revenue increase of 33% year-over-year and reached $3.27 billion in generated revenues.

- Additionally, the Gross Payment Volume (GPV) for its peer-to-peer transactions business reached $4.90 billion. This shows a growth of 24% year-over-year.

- Furthermore, as of March, Cash App Card recorded an impressive surge with 20 million monthly active users marking a robust YoY growth rate of 34%.

Image Source

- In 2023, Cash App boasted a user base of 55 million monthly active users. Plus, during the same period, 22 million individuals were in possession of a Cash Card.

There exist numerous statistics that captivate business giants with the idea of incorporating such a mobile app development into their operations.

But how does this P2P app work? Would you like to know? If yes, let’s find them below!

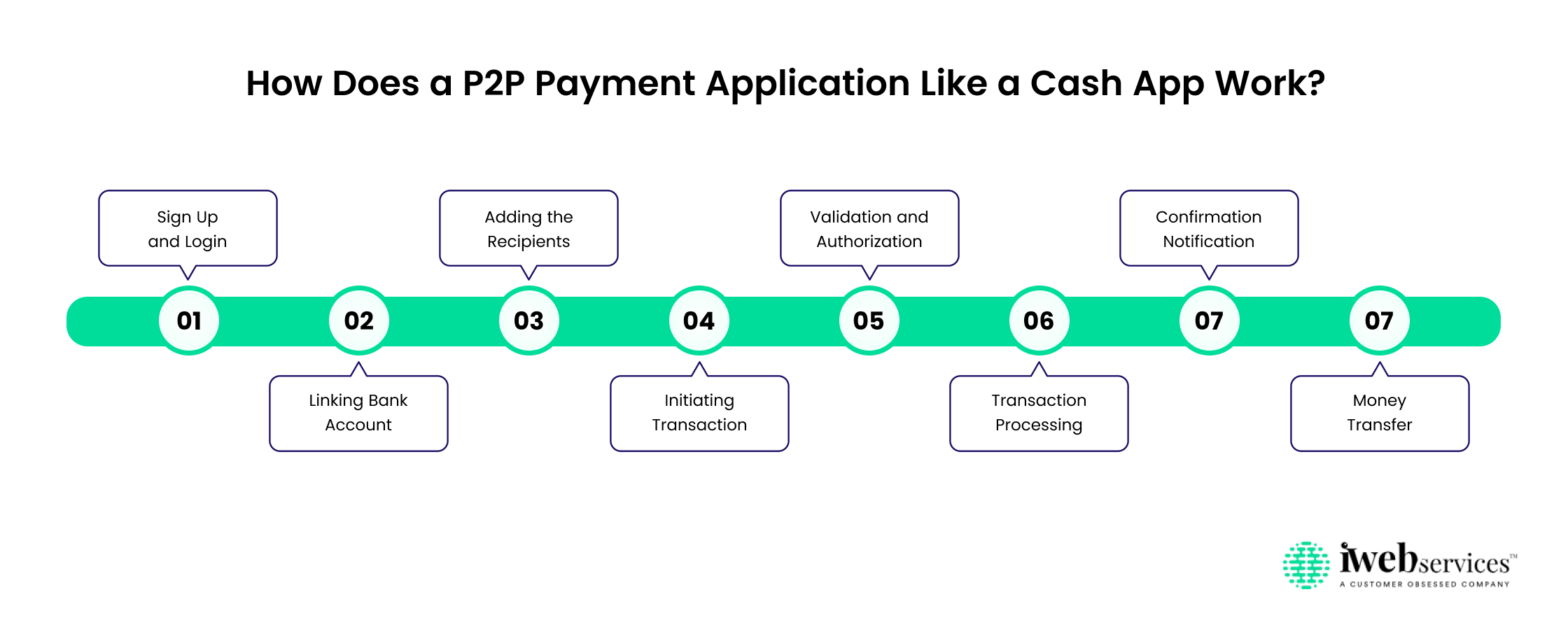

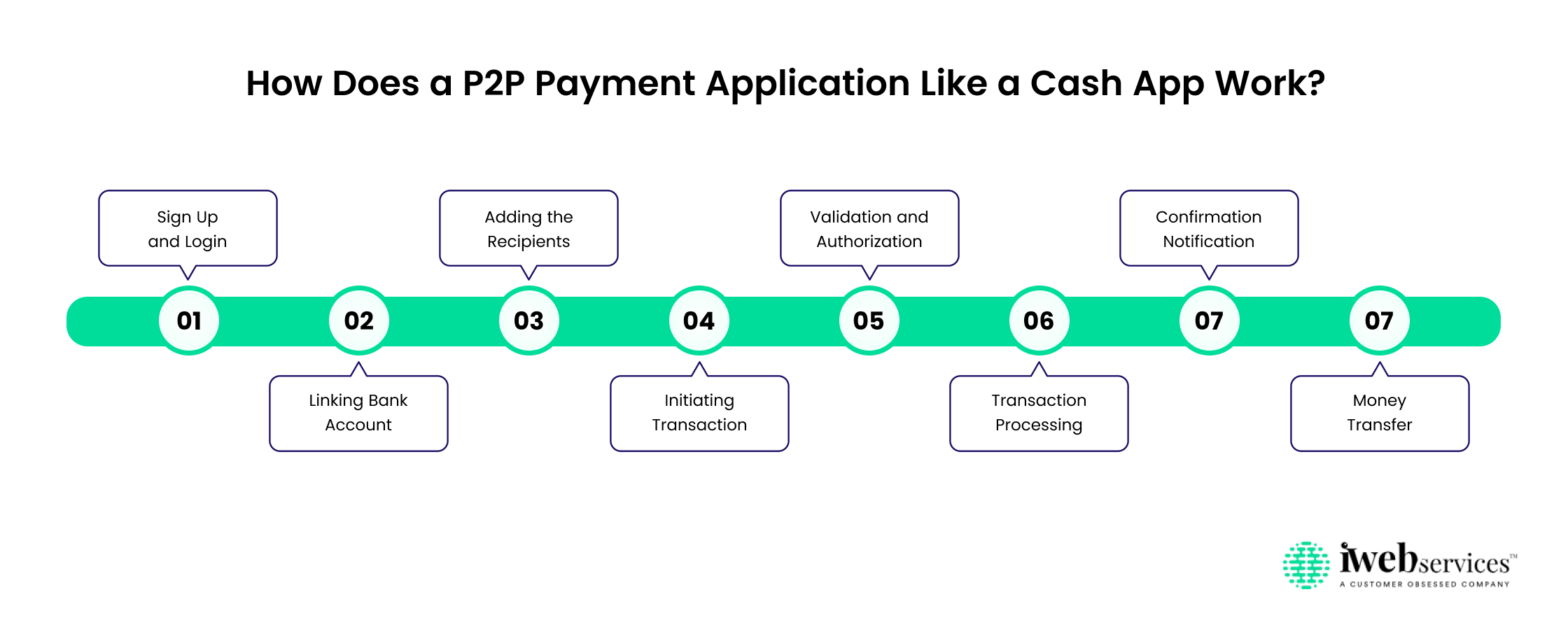

How Does a P2P Payment Application Like a Cash App Work?

P2P payment apps connect directly with your bank account or card to securely and efficiently move money from your account to the recipient’s. Here’s how it works –

First things first, you need to link your bank account or credit card to the P2P app. This is a one-time setup that requires you to enter your account details, which are then encrypted and stored securely.

Safety first, after all!

Moreover, it is not risky to share bank details. Most reputable P2P payment apps use advanced security measures like-

- Two-factor authentication (for an additional layer of security during login or transaction).

- Encryption

- Secure Socket Layers (SSL)

- Tokenization

Plus, they adhere to global banking security standards and regulations that provide an additional layer of protection to their users.

Furthermore, once the account is linked, making a payment is as simple as entering the recipient’s phone number, email address, or unique user ID associated with their account on the same app.

Then, just input the desired amount to send and confirm the transaction. A notification is sent to the recipient about the payment and the transaction is reflected in both parties’ transaction histories.

But wait, there is more in P2P payment applications. Besides just sending and receiving money, such apps are packed with some other features too.

You can split bills with your friends after a night out, pay for services, and even manage your finances. Some apps offer features like-

- Investment options (Stocks and Cryptocurrencies)

- Budget Tracking

- Tax Filing

There are more things that these can do. But here is one thing- as a budding entrepreneur, you should realize the potential of these apps not just as a means of transaction, but as an essential financial tool for your users.

You can hire an app development company to help you harness the potential and cater to the needs of your users to create a successful and popular P2P payment app like Cash App.

Now, you may be wondering, Why should I jump into developing a P2P payment app like Cash App. Well, we have highlighted some of the reasons for you below.

Why Should You Develop a P2P Payment App like a Cash App?

Several reasons attract one to get their hand into P2P payment app development like Cash App:

# Reason 1. Convenience is King:

First off, everyone loves convenience. Specifically when things are getting digital more these days. Nobody wants to walk around with a wallet full of cash or wait in line at an ATM anymore.

But with P2P payment apps like Cash App, the transaction process is as simple as sending a text message. Exactly why diving into the development of such an app makes more sense over here.

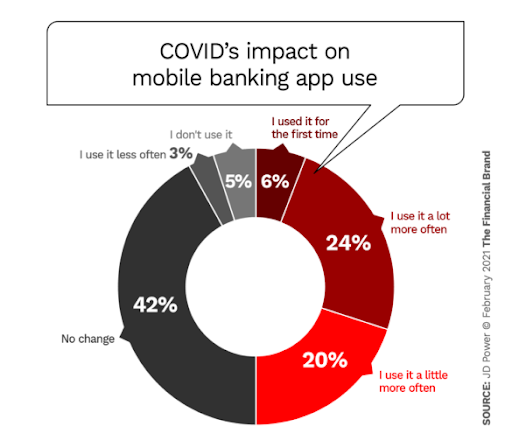

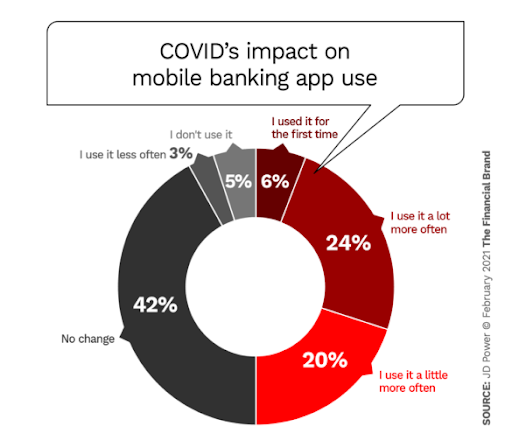

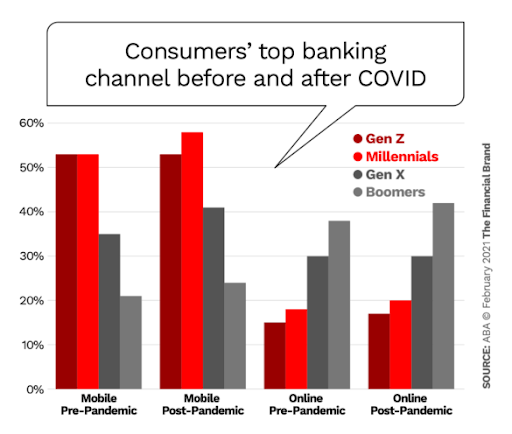

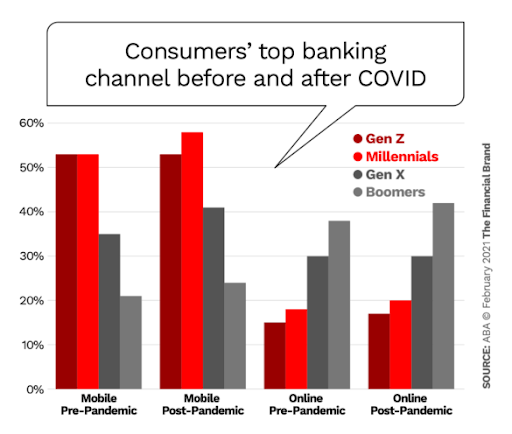

If we see a report from the ABA, 39% of consumers currently state that they use mobile apps as their main source for banking. This was marking a 3% rise from pre-COVID figures.

Besides, the percentage of people who rely on desktop computers for accessing their accounts increased to 32% in 2020, up from 29% prior to the virus outbreak.

Image Source

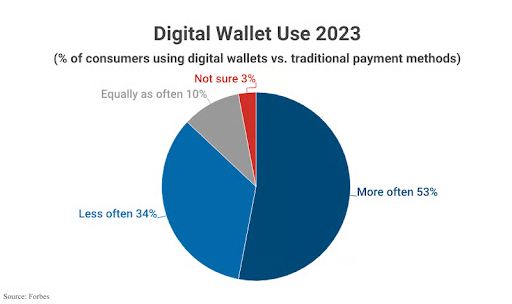

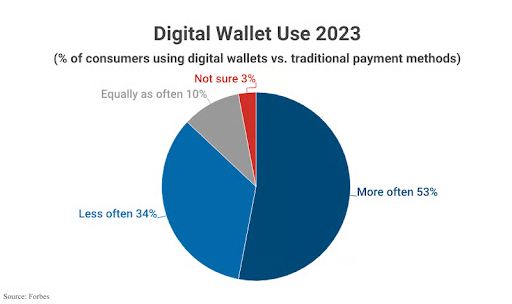

# Reason 2. The Growing Digital Wallet Trend

We have been living in the age of digital transformation for some time. An increasing number of individuals are becoming at ease with handling their finances on the Internet, and digital wallets are gaining popularity.

In 2023, digital wallets were used more frequently than traditional payment methods by 53% of Americans;

Image Source

Moreover, peer-to-peer payment applications play a crucial role in this trend. Creating an application similar to Cash App doesn’t just mean joining the current wave; it means leading it. This is your opportunity to access an expanding demographic of tech-savvy customers who seek a simpler method of financial management.

# Reason 3: Financial Inclusion is a Must

Here’s another reason– financial inclusion. For too long, certain demographics have been left in the dust when it comes to accessible financial services. However, P2P payment apps like Cash App are changing the game. They’re allowing people who might not have a traditional bank account to participate in the economy.

Imagine the empowerment of sending or receiving money instantly without the need for a bank account. By creating a P2P payment app, you’re not just building a business; you’re contributing to a more inclusive financial ecosystem.

# Reason 4. Revenue Models

These apps aren’t just sitting pretty; they’re churning out income through various channels. From transaction fees and premium services to in-app advertisements and affiliate programs, the revenue models are as diverse as they are lucrative.

And the best part? The more your app gets used, the more you earn. It’s a virtuous cycle of profit that’s enticing for any entrepreneur. Dipping your toes into P2P payment app development can seem like planting a money tree that grows along with your user base.

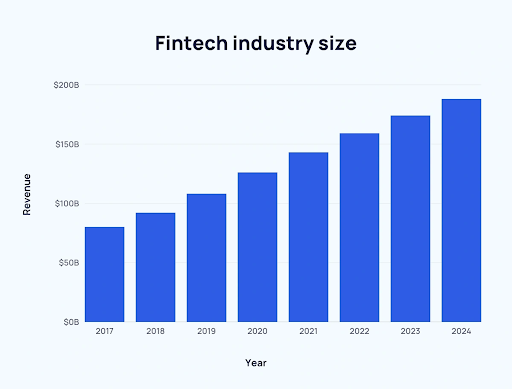

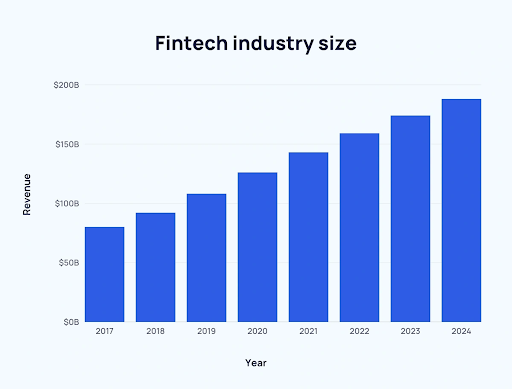

# Reason 5. Fintech is Future-Proof

The fintech industry isn’t just booming; it’s future-proof. The global Fintech industry generated approximately $90.5 billion in revenue in 2017. Since then, that number has grown by over 100%.

Image Source

As technology advances and digital finance becomes even more entrenched in our daily lives, the demand for user-friendly financial apps will only skyrocket.

Develop a P2P payment app now to position yourself at the forefront of this rapidly growing market.

The next big question that would arise when developing P2P payment apps like Cash is: what features do these apps have that make them worthy?

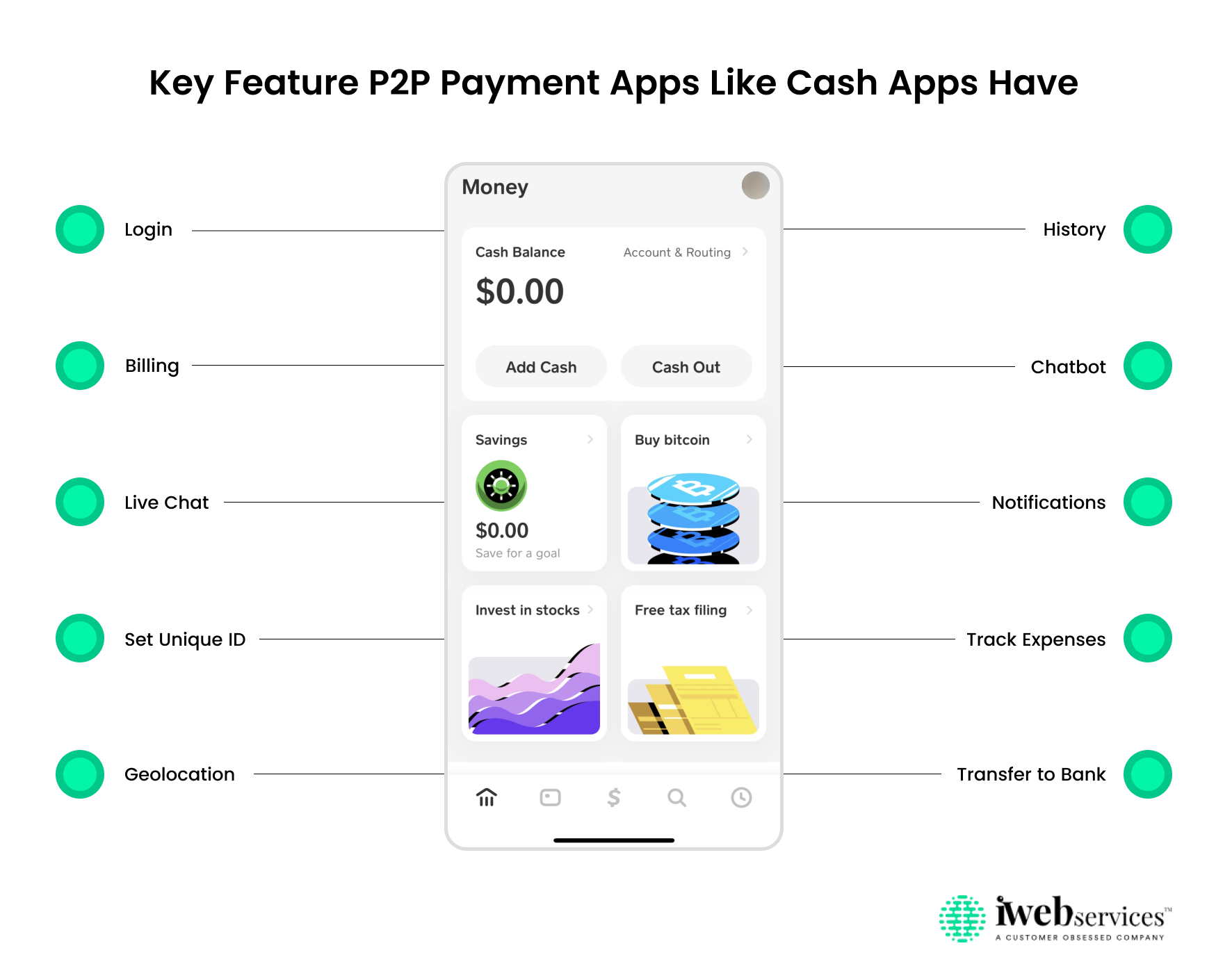

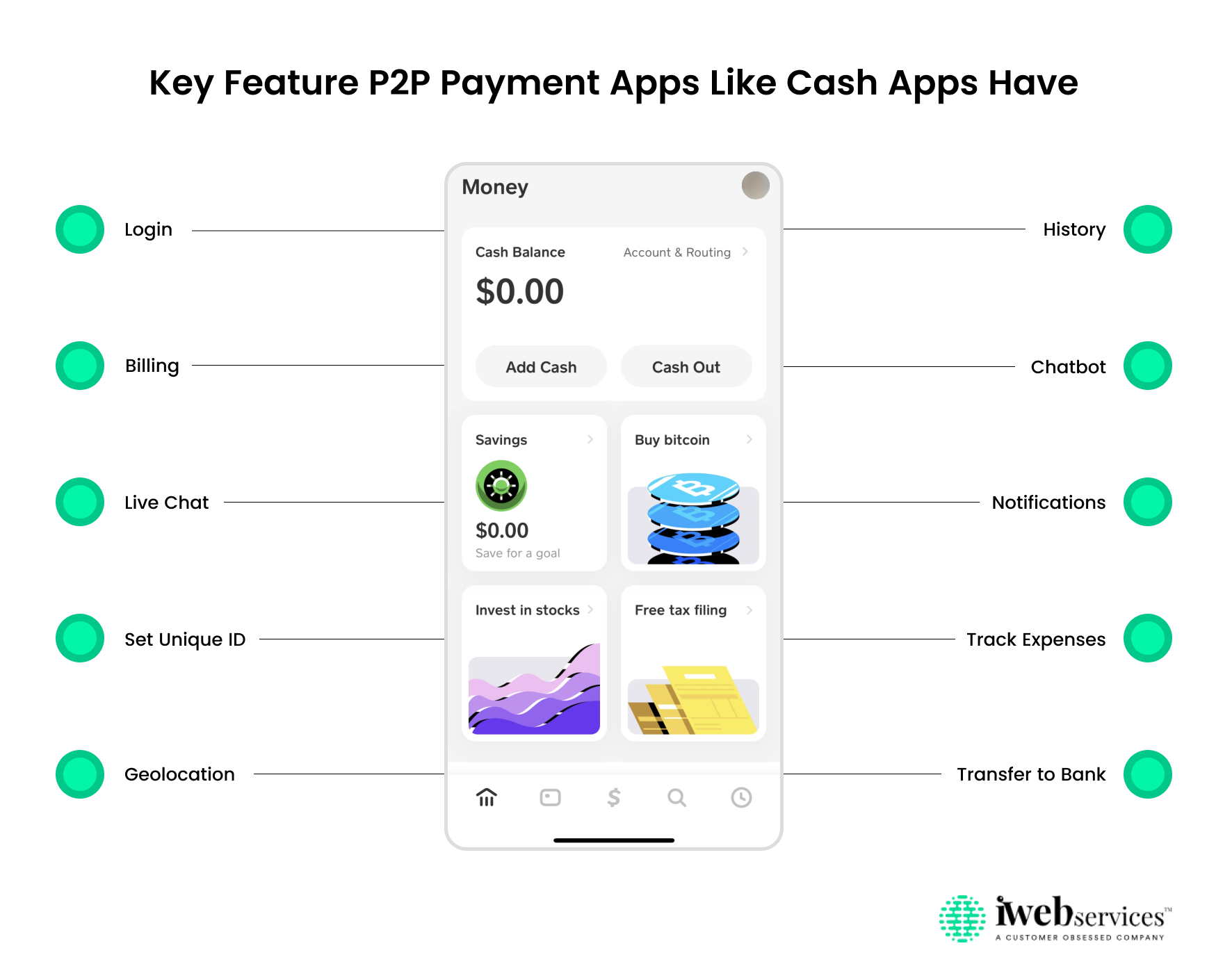

Key Feature P2P Payment Apps Like Cash Apps Have

In the process of developing a mobile app, determining its features is essential as it defines the functionalities it can perform. When creating a peer-to-peer payment app, several typical features are typically included.

1. Login: Signing up for a P2P payment app should be a breeze. You can use your social media accounts or phone number to get started. Don’t complicate this process, as the less friction, the better the result.

2. Billing: Need to pay a bill? No problem! P2P payment apps allow you to scan and submit bills, making bill payments a breeze. Some apps even let you create and save transactional invoices within the app for easy access.

3. Live chat: Even though P2P payment apps eliminate the need for face-to-face interactions, sometimes you might still need assistance. That’s where live chat comes in handy. You can chat with customer service representatives to resolve any issues or queries you might have.

4. Set unique ID: For added security, P2P payment apps provide users with a unique ID and password for each transaction. Some apps even require an OTP (One-Time Password) each time you launch the app, ensuring a higher level of security.

5. Geolocation: Need to make a payment to someone far away? Geolocation makes it possible! You can use GPS tracking to locate people and make payments with just a tap on their name. This feature saves time and doesn’t require any account information, making transactions quick and easy.

6. History: To check your transaction history and even filter it by date range, the P2P app should have a history feature in it. This feature helps you keep tabs on your payments and receivables, adding value to your experience.

7. Chatbot: A chatbot feature in P2P payment apps can assist you with any issues that may arise during transactions, such as incorrect withdrawals or lost internet access.

8. Notifications: Stay informed about your payments with real-time notifications! P2P payment apps notify you when a payment is initiated and completed. You can also receive alerts about upcoming bill due dates, discounts, and special offers.

9. Track expenses: Keep an eye on your spending with spending analysis! This feature helps you manage your spending better and set spending limits if needed.

10. Transfer to bank: Want to transfer funds from the app to your bank account? Many P2P payment apps offer this feature, allowing you to move money as needed. Keep in mind that there may be a transfer charge for bank transfers, depending on the app’s business model.

Implementing these features can boost user engagement and make your P2P payment app stand out. However, be prepared to face challenges along the way. It’s all part of the journey to creating a successful app in the competitive FinTech market.

Now that we’ve established what P2P payment apps are and their importance, you’re probably wondering,

How can I create a masterpiece like Cash App? Well, keep reading because we’re about to spill the beans on developing a P2P payment app that might just be the next big thing.

Steps to Develop a P2P Payment App Like Cash App

Step 1: Market Research is Your New Best Friend

Before jumping headfirst into the world of app development of any type be it a food ordering app or a P2P payment app it’s crucial to do your homework.

And by homework, we don’t mean solving calculus problems. Instead, you have to understand the market. Analyze your competitors. Some of the market giants in P2P payment include Venmo, PayPal, and of course, Cash App itself. Look at what they’re doing right and maybe even more importantly, where they could improve.

Identifying these gaps could give you that competitive edge. Also, keep an eye out for –

- What customers are saying about these payment apps?

- What features do they love using in it?

- What grinds their gears?

If you have the answers to these questions- you’d be surprised at how much you can learn just from user feedback.

Step 2: Determine Your Unique Value Proposition

- What makes your app different?

- Why should users choose your app over the other P2P apps?

Maybe you offer lower transaction fees, faster transfer speeds, or a more user-friendly interface. Whatever it is, make sure it shines through. It’s not just about being another app on the market; it’s about being the app everyone can’t live without.

Step 3: Prioritize Mobile Platform & Tech Selection

Android and iOS dominate the mobile platform, but they come with their unique sets of users. Conduct research to figure out where your ideal users hang out. Is it on Android or iOS? Or do you need to go the extra mile and develop for both?

The platform you choose can greatly impact your development costs and timeline. Android, with its wide array of devices, can be a bit trickier to develop due to the need for extensive testing.

iOS, while more streamlined, comes with its own set of strict design and development guidelines. Besides, hybrid vs. native app development is another big call. Choose wisely, as your decision here is crucial for the future of your app.

Moreover, here is a list of some common tech stack that is usually used in a P2P payment app like Cash app-

| Category | Technology |

| Frontend | React Native, Flutter |

| Backend | Node.js, Express.js |

| Database | PostgreSQL, MongoDB |

| Payment Gateway | Stripe, PayPal, Square |

| Blockchain | Ethereum, Hyperledger |

| Authentication | OAuth 2.0, JWT |

| Notifications | Firebase Cloud Messaging |

| Hosting | AWS, Azure, Google Cloud |

| CI/CD | Jenkins, GitLab CI |

| Security | SSL/TLS, Encryption |

| DevOps | Docker, Kubernetes |

Step 4: Secure Your App

In the digital world, security isn’t just a fancy feature; it’s a necessity, especially when you’re handling people’s money. Users need to trust your app with their financial transactions, and you don’t want to break that trust.

Thus, ensure that you are using top-notch security measures like encryption, two-factor authentication, and biometric scans.

You don’t want to be known as the app that had a security breach. Trust us, it’s not a good look.

Step 5: Secure a Reliable Technology Partner

You’ve got a brilliant idea and a good grasp of the regulatory requirements. Now, you need someone to bring your vision to life.

You have to find a reliable app development company who have a broad range of experience in the finance sector,

This partner will help you select the right tech stack (like whether you should go for React Native or not) , design a user-friendly interface, and ensure that your app is as secure. Remember, in the P2P payment space, trust and reliability are everything.

Step 6: Design an Intuitive User Interface

Ever used an app that made you feel like you needed a Ph.D. to figure it out? Of Course, not. Your P2P payment app should be the complete opposite.

A clean, intuitive interface that guides the user seamlessly from one action to the next can significantly enhance user experience. The easier and more pleasant your app is to use, the more likely users are to stick around. Ask your app design service provider to keep it simple but significant.

Step 7: Compliance and Regulations are Your New Norm

The most important thing that you should take care of is to develop an app that is compliant with financial regulations. So, look into the regulations in the countries or regions where you plan to operate.

There are several regulatory bodies and laws that could apply to your app, depending on the services you offer and the markets you enter. Some of the most common include:

- GDPR

- CCPA (California Consumer Privacy Act):

- PCI DSS (Payment Card Industry Data Security Standard):

- FACTA (Fair and Accurate Credit Transactions Act):

Compliance with financial regulations is not only a legal requirement but also crucial for building trust with your users. By ensuring your app is compliant, you not only avoid potentially hefty fines and legal issues but also signal to your customers that their security and privacy are your top priorities.

Step 8: Rigorous Testing Is Not Optional

You’re nearly at the finish line, but before you launch, you need to test. And then test some more.

We can’t stress enough how important testing is. You can’t skip the testing phase in app development. When you hire app developers they should consider different testing methods, like

- unit testing

- integration testing

- usability testing

Invite a small group of users to try out your app and give feedback. This beta test can provide invaluable insights into any potential issues or areas for improvement. The goal is to catch any bugs and fine-tune the user experience before going live to the public.

Step 9: Plan a Stellar Launch and Marketing Strategy

If you’ve developed an amazing app but no one knows about it, does it even exist? A solid launch and marketing strategy is vital. Get the word out there through social media, influencer partnerships, press releases, and any other means necessary. Your app might be the next big thing in P2P payments, but only if people know it exists.

Don’t forget about App Store Optimization (ASO) to make sure your app ranks well in App Store searches. And remember, launching your app is just the beginning. Gather user feedback, keep refining your app, and stay on top of market trends to ensure your app’s continued success.

Step 10: Keep Improving

The launch isn’t the end of the road; it’s just the beginning. Gather user feedback and continuously work on improving your app. Adding new features, improving user experience, and fixing any bugs that pop up are all part of keeping your app relevant and loved by users.

So there you have it, folks, a rough roadmap to creating a P2P payment app that might just make you the next fintech sensation. Remember, the journey of a thousand miles begins with a single step, or in this case, a single tap. Good luck!

Cost to Develop P2P Payment App Like Cash App

For creating a P2P payment application similar to Cash App, you are in on an exhilarating yet challenging project. This endeavor revolves around the intersection of convenience and essentiality. Considering this, let’s delve into specifics – what will be the financial implications for your venture?

The truth is, we can’t give exact cost figures to develop a Cash App. Why, you ask? Because the cost hinges on several factors. These include your –

- app’s complexity

- the platforms you’re aiming for (Android, iOS, or both)

- security features (because let’s face it, no one wants their hard-earned money)

- the geographical location of your development team (like hiring app developers in India would cost significantly less compared to developers in North America or Western Europe due to the difference in labor costs)

For a basic app, you might be looking at a range starting from $40,000 to $60,000. But let’s say you want to add modern features like AI/ML integration or implementation of blockchain tech on your app – now a price range that can go well over $100,000.

Closing Thoughts

There you have it, a roadmap to developing a P2P payment app like Cash App. All you need is diligence, patience, and a keen eye for detail. If so, you will see the rewards of bringing your vision to life can be immensely satisfying.

So, if you’ve been contemplating diving into the world of app development, focusing on P2P payment apps might just be your golden ticket. You have to just find the right tech partner who offers mobile app development services that can help bring your vision to life. By working closely with them, you can ensure your app is well-built, secure, and user-friendly.