FinTech development services have been helping BFSI sector companies disrupt traditional financial services and challenging established business models. However, fintech also brings risks and challenges, such as data security, lack of transaction monitoring, consumer protection, and financial stability. To ensure that it keeps users’ data safe and stabilizes itself against ever-growing threats or malpractices, regulators around the world have been developing new regulatory frameworks to promote innovation while ensuring that consumer protection and financial stability are maintained.

Following FinTech compliances and regulations is a pressing matter since the tech industry is lagging in catching up to the rapidly evolving regulatory landscape. 93% of fintechs find it challenging to meet compliance requirements, while in 2023, fintech companies and crypto firms paid $5.8 billion in fines for non-compliance such as insufficient customer due diligence, and failure to report suspicious actions, to name a few. Among the fintech regulations that have been a matter of concern is GDPR or General Data Protection Regulation (GDPR). What is GDPR? Why businesses have been struggling to implement it and what are the challenges they have been facing if they don’t? If you’re also wondering about these questions, then this blog is for you.

Basics of GDPR and Fintech Regulations Explained: What is GDPR & Its Importance

According to Investopedia, GDPR or “the General Data Protection Regulation (GDPR) is a legal framework that sets guidelines for the collection and processing of personal information from individuals who live in and outside of the European Union (EU) and the European Economic Area (EEA).” The set legal framework was approved in 2016 but got into motion in 2018, it has been established as the toughest security and privacy law in the world. The primary goal is to give consumers control over their data by holding companies responsible for the way they handle, store, and treat the information. Companies or organizations who are non-compliant may face a maximum penalty of 4% of their annual global turnover, or €20 million, whichever is higher.

One of the most defining features of GDPR is that the regulation applies regardless of where your websites are based, which means it must be heeded by all sites that attract European visitors, even if they don’t specifically market goods or services to EU residents. In simpler terms, if you process the personal data of EU citizens or residents, or you offer goods or services to such people, then the GDPR applies to you even if you’re not part of the EU.

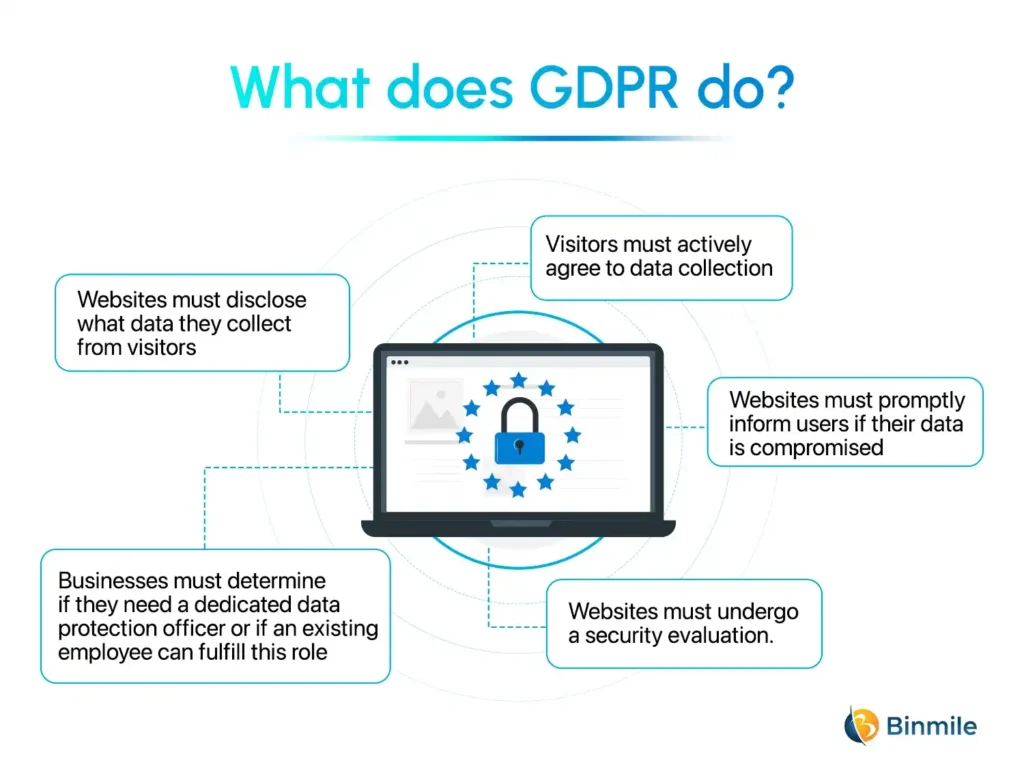

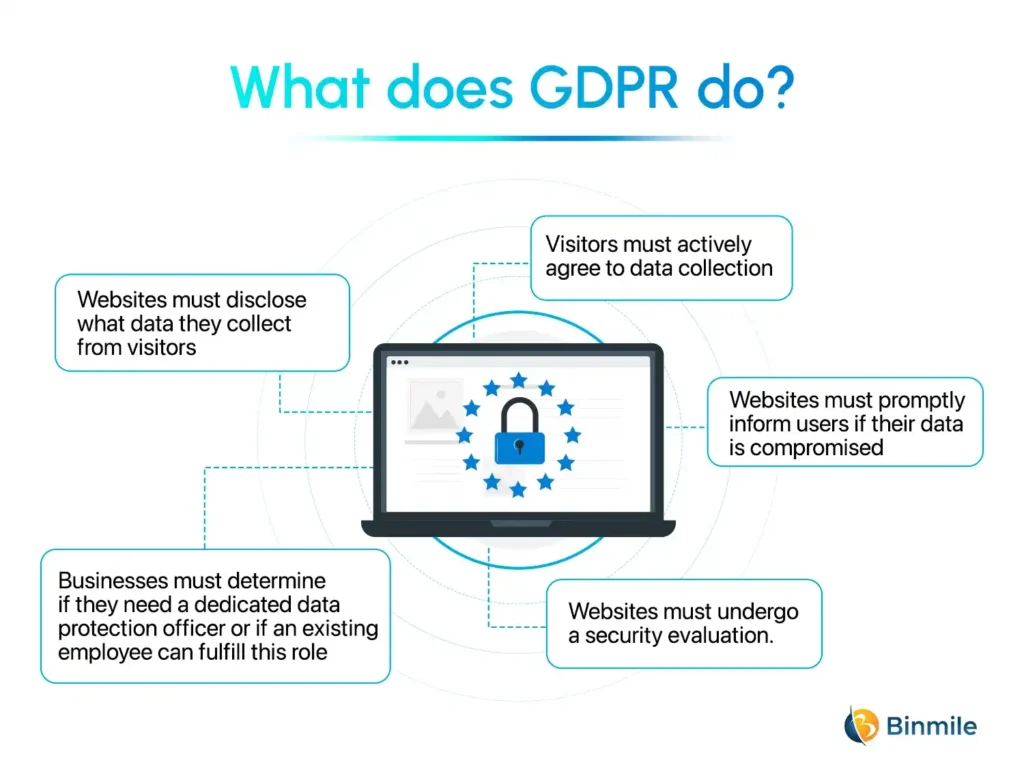

What does it do?

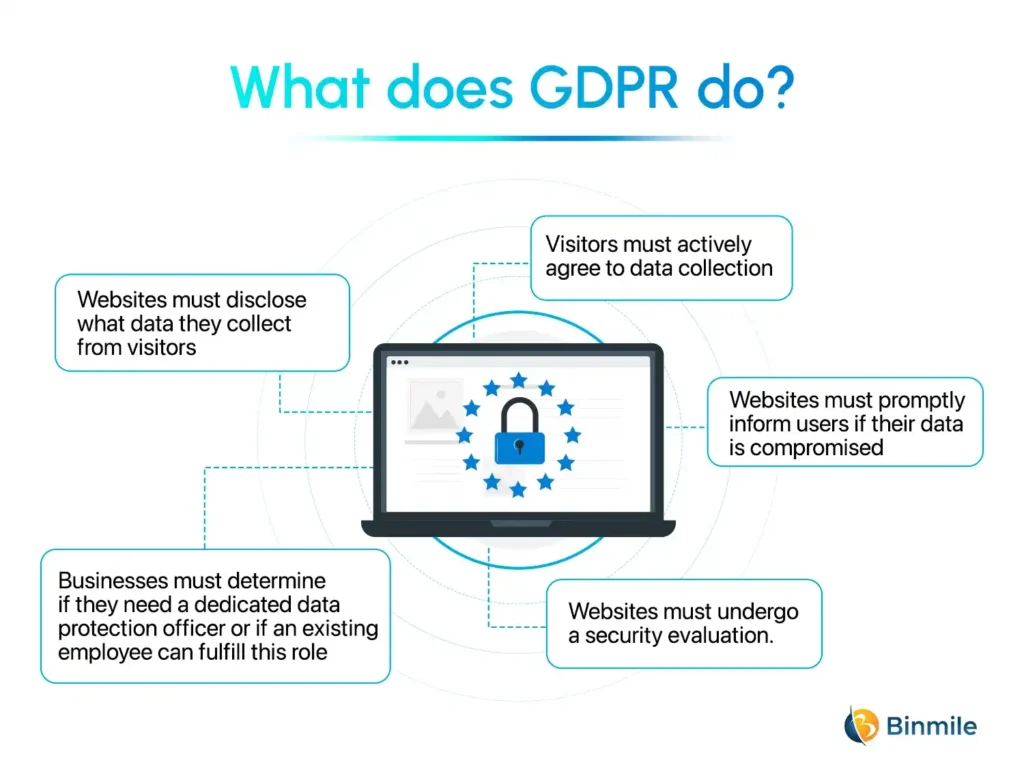

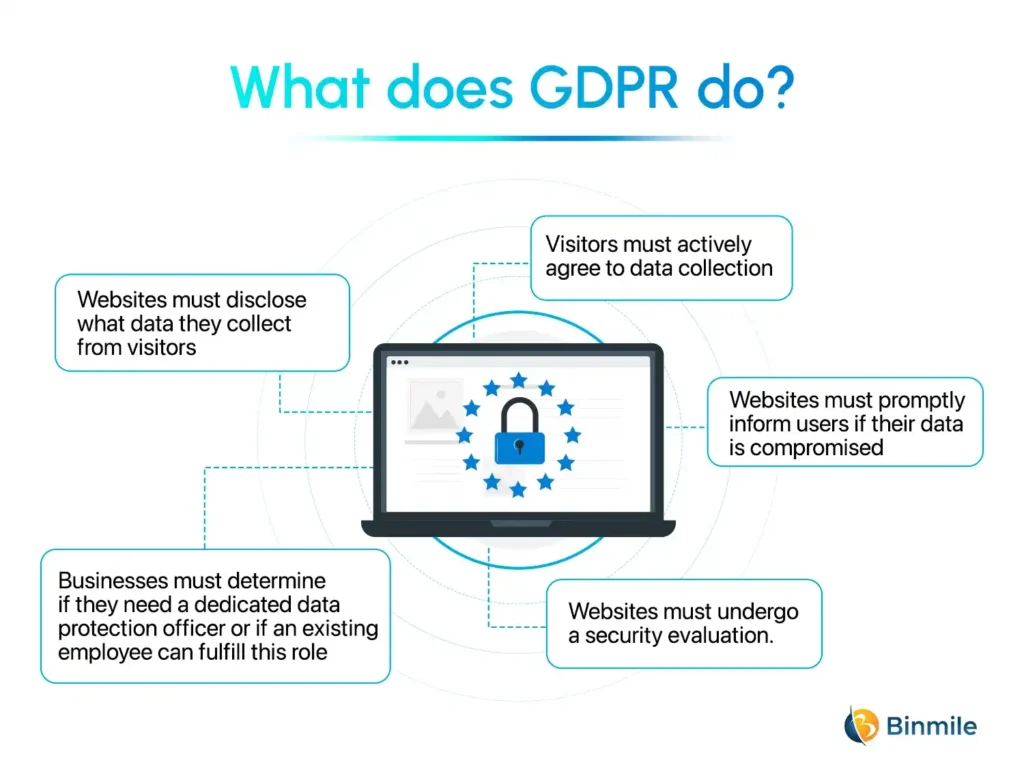

The law requires companies to use clear and understandable language on their websites. It also mandates that:

- Websites must disclose what data they collect from visitors.

- Visitors must actively agree to data collection.

- Websites must promptly inform users if their data is compromised.

- Websites must undergo a security evaluation.

- Businesses must determine if they need a dedicated data protection officer or if an existing employee can fulfill this role.

Why Do We Need Regulation For Fintech Firms?

Regulations have evolved to protect financial institutions, their customers, and the wider economy from financial crime. AML and KYC regulations are frequently updated to reflect changes in fraudulent and criminal methods. Wherever fintechs operate – whether in financial services, customer verification, or transaction support – they should ensure the same checks and security as the major financial institutions.

Protection and compliance are crucial elements – but there are other reasons for fintech to comply with regulations, such as:

- Trust and Reputation: GDPR and other FinTech compliance builds trust with customers, demonstrating a commitment to protecting their sensitive financial data, thereby enhancing brand reputation and customer loyalty.

- Risk Mitigation: They help you establish a robust data protection framework, minimizing potential financial losses. So, adhering to GDPR safeguards fintechs from hefty fines and legal repercussions in case of data breaches.

- Competitive Advantage: Demonstrating GDPR compliance positions fintechs favorably in the market. It signals a strong commitment to security and privacy, attracting customers who prioritize data protection.

Turn compliance challenges into opportunities with our result-oriented and reliable software development service for businesses of all types & scales!

Top Challenges for FinTech Companies In Being GDPR Complaint

Here are major hurdles for FinTech companies in GDPR compliance, we’re also sharing quick tips to overcome them:

#1 Complex Data Mapping and Management

FinTech companies often handle vast amounts of personal and financial data across multiple systems and jurisdictions. This makes it difficult to track and manage this data in compliance with GDPR.

Tip: Organizations can implement comprehensive data mapping tools and processes. One, regularly audit your data flows and storage and consider adopting advanced data management solutions that offer automated data discovery and classification features.

#2 Balancing Innovation with Compliance

It becomes challenging to be innovative while maintaining GDPR’s stringent requirements and it may potentially slow down product development and deployment.

Tip: To deal with this challenge, FinTech companies should adopt a “Privacy by Design” approach. Under this, you need to integrate compliance considerations into your development process from the outset. Thus, create cross-functional teams that include both innovators and compliance experts to ensure new products and features align with GDPR requirements.

#3 Ensuring Valid Consent and Managing User Rights

FinTech services need extensive data processing, which already is a time-consuming effort. Adding to this is obtaining and managing valid consent for each processing activity, while also handling user rights requests efficiently, which can be challenging.

Tip: Develop clear, user-friendly consent mechanisms. Implement robust systems for managing user preferences and handling data subject requests. Consider using consent management platforms that can automate much of this process.

#4 Cross-Border Data Transfers

Many FinTech companies operate globally, necessitating frequent cross-border data transfers. GDPR’s strict rules on such transfers can pose significant challenges.

Tip: Thoroughly assess your data flows and identify all cross-border transfers by implementing appropriate safeguards such as Standard Contractual Clauses or Binding Corporate Rules. One must also stay informed about developments in international data transfer regulations and adjust your practices accordingly.

Also Read : Fintech Business Model Guide

Effective Steps for FinTech Companies to Improve GDPR Fintech Rules & Regulations

Here are some best practices for achieving compliance to help you avoid issues or penalties for being non-compliant with GDPR or other FinTech compliances.

Step 1: Conduct a Comprehensive Regulatory Assessment

Begin by mapping out all regulations that apply to your FinTech business, including GDPR, PSD2, MiFID II, AML directives, and local financial regulations. Create a detailed compliance checklist for each regulation, identifying specific requirements that affect your operations. This may involve consulting with legal experts or regulatory specialists to ensure no critical aspects are overlooked.

Step 2: Implement Robust Data Protection Measures

Upgrade your data security infrastructure to include state-of-the-art encryption for data at rest and in transit. Implement strict access controls using multi-factor authentication and the principle of least privilege. Develop and enforce comprehensive data minimization policies, ensuring you only collect and retain necessary data. Establish secure protocols for data transfers, paying special attention to cross-border transfers which may require additional safeguards under GDPR.

Setp 3: Strengthen Customer Consent and Rights Management

Revamp your consent mechanisms to ensure they are explicit, informed, and freely given. Develop user-friendly interfaces for customers to manage their consent preferences. Create efficient processes for handling data subject requests, including access, rectification, erasure, and portability. Ensure your privacy policies and terms of service are clear, comprehensive, and easily accessible to users.

Step 4: Enhance Financial Crime Prevention

Implement advanced Know Your Customer (KYC) procedures, leveraging technology like AI and biometrics for identity verification. Develop sophisticated Anti-Money Laundering (AML) systems that can detect complex patterns of suspicious activities. Establish a risk-based approach to customer due diligence, adjusting the level of scrutiny based on the risk profile of customers and transactions.

Step 5: Establish a Robust Governance Structure

Appoint qualified individuals to key roles such as Data Protection Officer and Compliance Officer. Ensure these roles have the necessary authority and resources to effectively carry out their responsibilities. Form a cross-functional compliance committee that meets regularly to discuss regulatory challenges and strategies. Develop a comprehensive set of policies, procedures, and documentation that clearly outline your compliance efforts and can be presented to regulators if required.

Step 6: Implement Secure and Compliant Payment Systems

Ensure your payment infrastructure fully complies with PSD2 requirements, including implementing Strong Customer Authentication for relevant transactions. If applicable, develop secure and efficient open banking APIs that meet regulatory standards. Implement robust transaction monitoring and reporting systems that can flag unusual activities and generate required reports for regulatory bodies.

Step 7: Develop a Culture of Compliance

Implement a comprehensive training program that covers all relevant regulations and is tailored to different roles within your organization. Regularly update this training to reflect changes in the regulatory landscape. Establish clear policies and procedures for regulatory compliance and ensure they are easily accessible to all employees. Implement a system of regular internal audits and continuous compliance monitoring, using both manual checks and automated tools to identify and address potential compliance issues promptly.

Pro Tip:

Do as an outsourcing fintech development company you’re bound to follow GDPR or other FinTech compliances? Yes, you should. As a custom software development services company, you operate within a complex regulatory environment, so GDPR should be at the forefront. To ensure compliance, you must adopt a proactive approach to data protection. This involves implementing robust security measures, conducting thorough data mapping, and obtaining explicit consent from data subjects. Also, consider clear data processing agreements with clients that help you outline responsibilities and liabilities for both parties in case of mishaps. Doing so empowers you to prioritize data privacy and security with top-notch development services build trust with clients and foster long-term partnerships.

Get assistance in implementing these steps in your business to enhance your data management processes and ensure all-around data protection!

Closing Statement

There’s no doubt that GDPR and other regulatory finance rules are not just a legal obligation for FinTech companies, be they startups or established ones. There are many reasons it’s a fundamental component, one is building trust with customers and stakeholders and another is to avoid hefty fines or penalties. So, organizations need to prioritize GDPR and FinTech compliance to not only reduce risks but also position their organization as a trusted market leader. Hopefully, this blog has equipped you with the necessary insight to navigate the complex regulatory finance landscape. Moreover, this blog also helped you find best practices to thrive in the digital age while respecting the fundamental rights and freedoms of individuals.

However, compliance can be a tedious process that involves a lot of time, resources, and effort that most organizations can’t afford to spend, and on top of that, fintech compliance can be a challenging path to navigate in development, especially without the help of a compliance expert. So, if you’re looking for a streamlined and compliant software development service, we’ve got you covered. Our team of SDLCs are compliance experts and committed to building software with secure architecture, encryption mechanisms, data backup mechanisms, etc. to ensure the security of data subjects’ personal information.