In a world where the digital revolution is reshaping every corner of our lives, the banking sector stands at a crucial crossroads. The pandemic has not just accelerated the digital transformation in banking; it has made it a do-or-die scenario. As

traditional banking models scramble to adapt, a new frontier emerges, one where being digital-first is not just an advantage, it’s a lifeline. But amidst this seismic shift, a deeper, more profound change is taking root. It’s not just about going digital;

it’s about why we’re doing it in the first place.

Why the Mid-Size Bank Spends 2,000,000 Annually on Digital Transformation

Digital transformation in banking refers to the comprehensive integration of digital technology into all areas of banking, fundamentally changing how banks operate and deliver value to customers. It involves the use of innovative technologies such as artificial

intelligence (AI), machine learning, blockchain, data analytics, and cloud computing to enhance banking services.

Digital transformation in banking is driven by the need to meet changing customer expectations, improve operational efficiency, and address the competitive pressures from both traditional financial institutions and fintech startups. Based on data from U.S.

regional and community financial institutions with $4.4 billion in assets on average, the Alkami report finds that mid-size banks and credit unions more than doubled their investments in digital transformation in fiscal year 2022, to nearly $425,000 per $1

billion in assets.

The main goals of digital transformation in banking include:

- Customer Experience Enhancement. Banks leverage digital channels (e.g., mobile apps, websites) to offer personalized, convenient, and efficient services.

- Customer-Centricity. Empowering customers with self-service options, intuitive interfaces, and proactive financial guidance by embracing agile methodologies to swiftly adapt to changing market dynamics, customer preferences, and emerging

technologies. - Operational Efficiency. Technologies like AI and machine learning are used for tasks ranging from customer service (via chatbots) to risk management and fraud detection.

- Data-Driven Decision Making. Banks use big data analytics to gain insights into customer behavior, preferences, and trends for designing targeted products.

- Innovation and Product Development. Digital transformation encourages banks to create new digital products and services, such as digital wallets, peer-to-peer payments, embedded finance, and blockchain-based solutions.

- Enhanced Security and Compliance. Digital transformation also involves the implementation of advanced cybersecurity measures to protect sensitive data and transactions, and compliance with regulatory requirements through digital solutions.

- Collaboration with Fintech. Banks increasingly collaborate with fintech companies to leverage their technologies and innovations, providing customers with enhanced services and products.

- Sustainability and Ethical Practices. Integrating environmental, social, and governance (ESG) considerations into the digital transformation strategy by adopting sustainable and ethical practices in product development, operations, and

investments, reducing carbon footprint, and promoting responsible data usage. - Empowering Employees. Equipping employees with the necessary digital skills and providing them with a supportive work environment to effectively navigate the digital transformation journey by investing in training and upskilling programs,

fostering a culture of continuous learning, and encouraging cross-functional collaboration.

Digital transformation in banking is not just about adopting new technologies but also involves a cultural shift within the organization, requiring banks to become more agile, innovative, and customer-centric. It’s a strategic approach aimed at securing

a competitive advantage in the rapidly evolving digital economy.

Consumer Values Have Changed After the Pandemic

Effective strategy for the digital transformation in banking is the crucial factor determining whether a financial company will lose it all or strengthen its position in the market. A product that doesn’t carry any value or benefit to facilitate people’s

daily lives will not be viewed as a necessity.

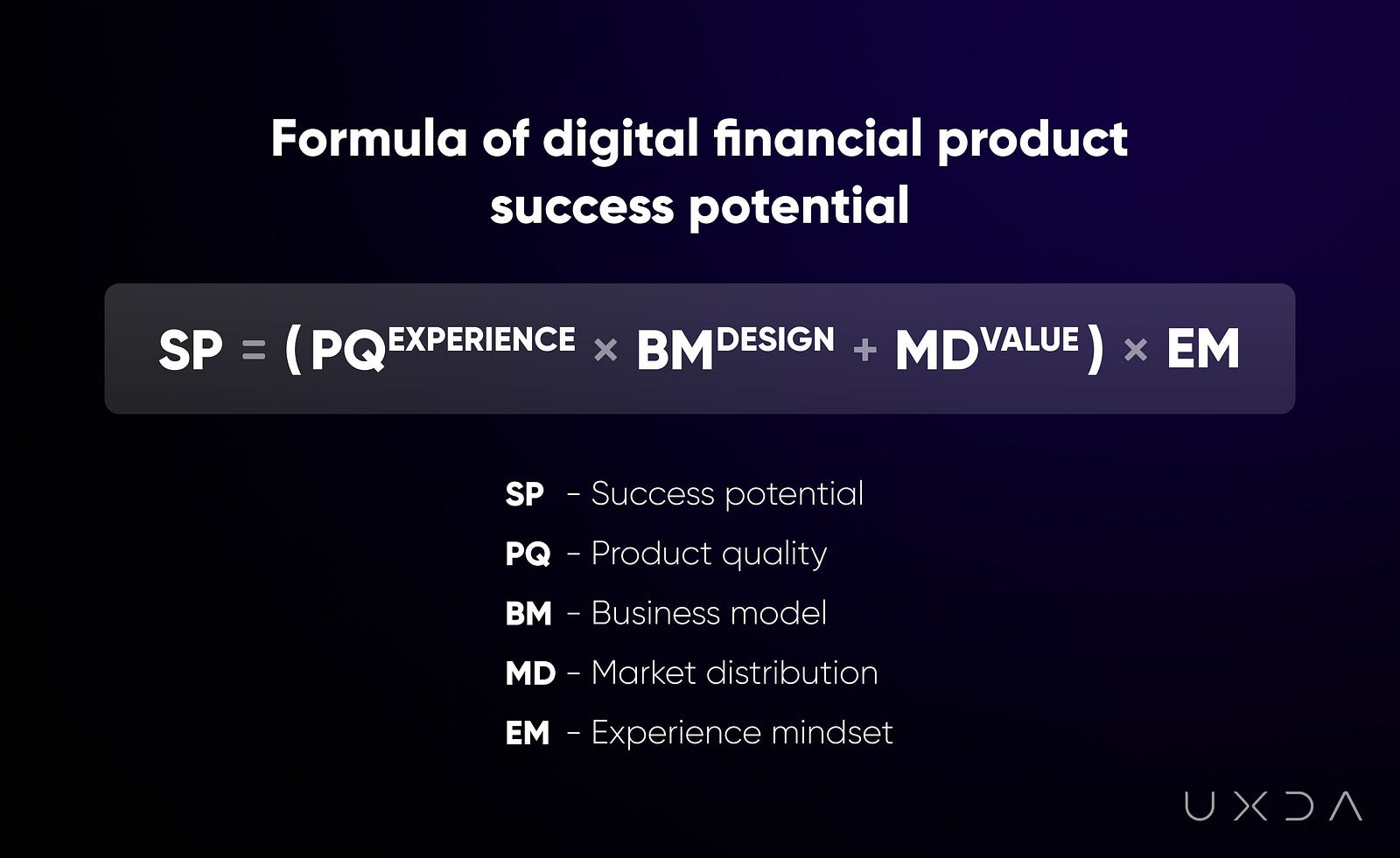

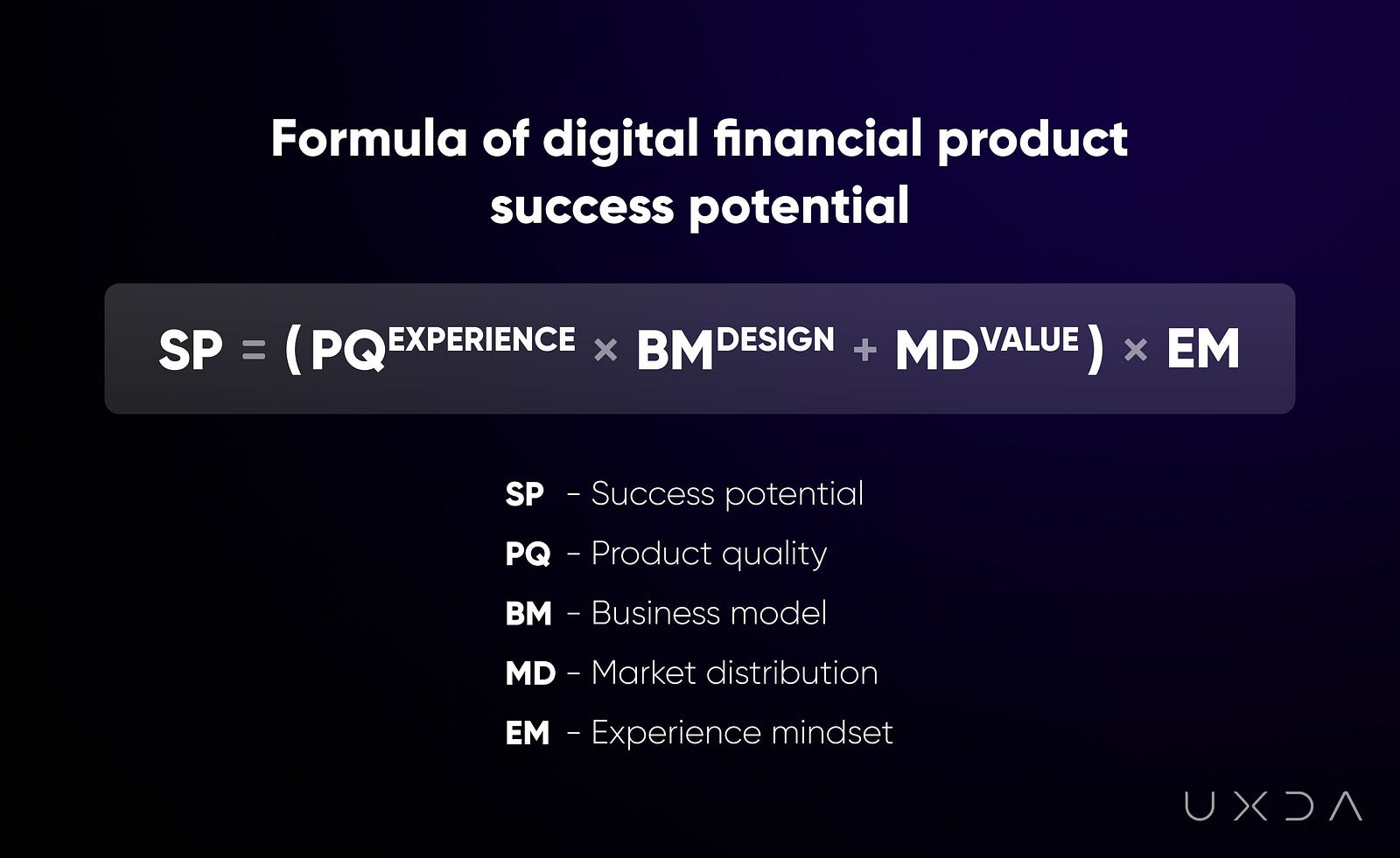

Global digitization and the post-pandemic have completely changed the rules of the game in the financial industry. When the primary goal was to make a profit, it was enough with a product, business model and market distribution to ensure the company’s success.

Now it doesn’t work that way anymore, consumers expect empathy and purpose-driven business.

In the digital age, purpose becomes the main advantage and successful digital products are differentiated by the experience, benefit, and value they provide. We redefine the business success formula by adding some very important elements to the traditional

model. The scale in which a financial business integrates these key factors defines the success potential of its digital financial products.

By embracing a purpose-driven strategy as the foundation for digital transformation in banking, banks go beyond simply adopting technology for the sake of efficiency gains or cost savings. Instead, they embrace a holistic approach that integrates technology

with their core purpose and values, focusing on generating positive societal impact, sustainable growth, and responsible practices.

With a purpose-driven strategy in their digital transformation journey, banks can create long-term value for all stakeholders while positively contributing to the broader society. It enables them to build a sustainable competitive advantage, attract and

retain customers, foster innovation, and navigate the ever-evolving landscape of the financial services industry.

Focus on Customer Experience is Crucial in Digital Banking Strategy

The quality of purpose-driven strategy implementation in the business DNA of a financial company is determined by five factors:

1. How well the customers context is taken into account;

2. How does your organization’s culture meet the strategy requirement;

3. How effective is your digital strategy in terms of digital age;

4. Is design implemented at all levels of your organization;

5. How does the value of your product match the market requirements.

In this article I will consider all three factors and show you how to purposefully create an advantage in this difficult time to turn the crisis into growth.

However, there can be several challenges to implementing a purpose-driven strategy in business. One challenge is that it can be difficult to identify and articulate a clear purpose or mission that aligns with the company’s goals and resonates with its target

customers. This can require extensive research, consultation, and collaboration with different stakeholders.

Another challenge is that a purpose-driven strategy can require significant changes to the way a company operates, which can be difficult to implement and require the support and buy-in of employees at all levels of the organization. Additionally, a purpose-driven

approach can require a company to prioritize long-term goals and social impact over short-term financial gains, which can be difficult for some organizations to balance.

1. Meet User Expectations Based on Customers Context

Financial companies are trying to find ways to cope with post-pandemic customer behavior switches and provide the best digital service to their customers. Unfortunately, these efforts can become meaningless if they haven’t dived deep into exploring the user

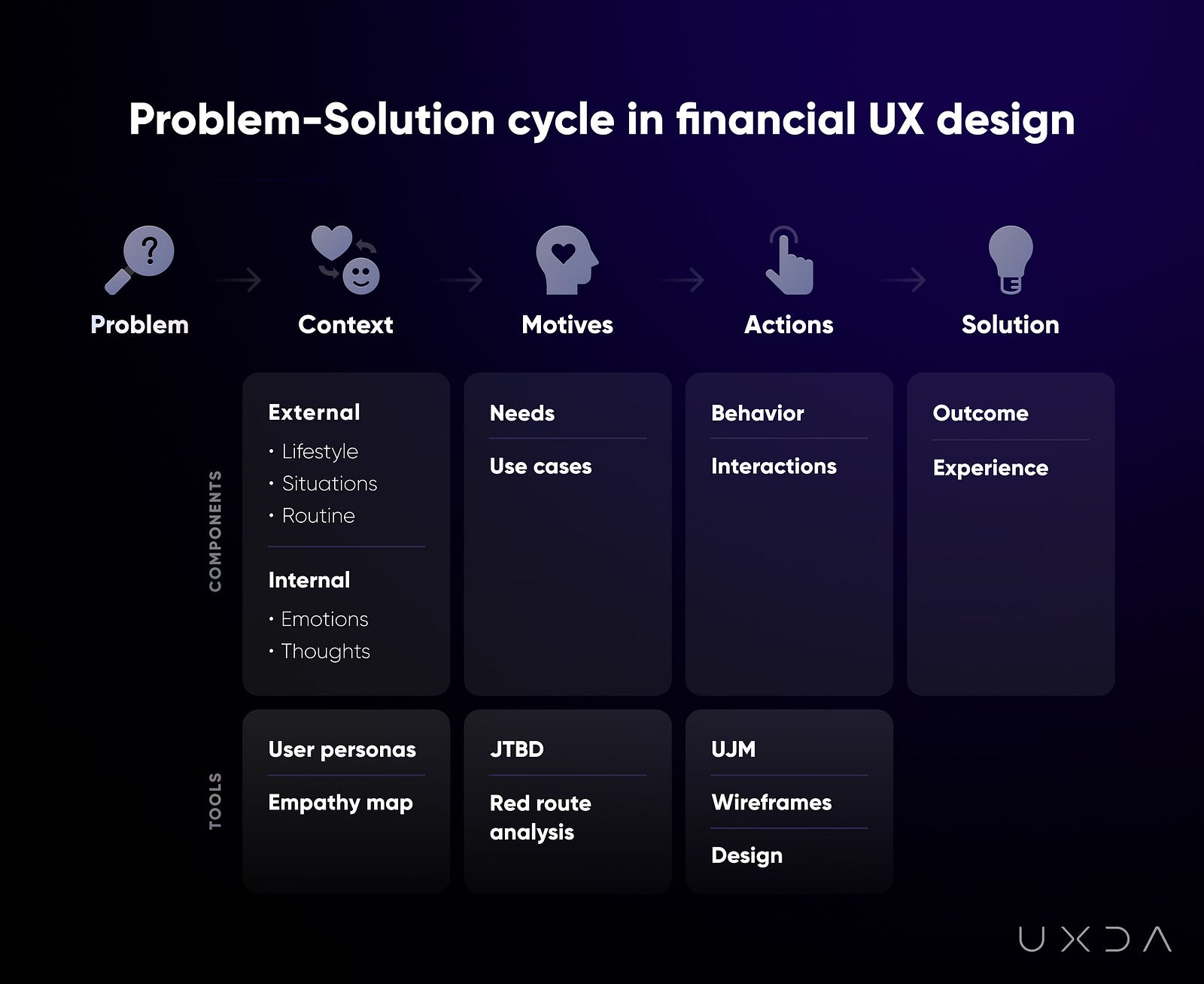

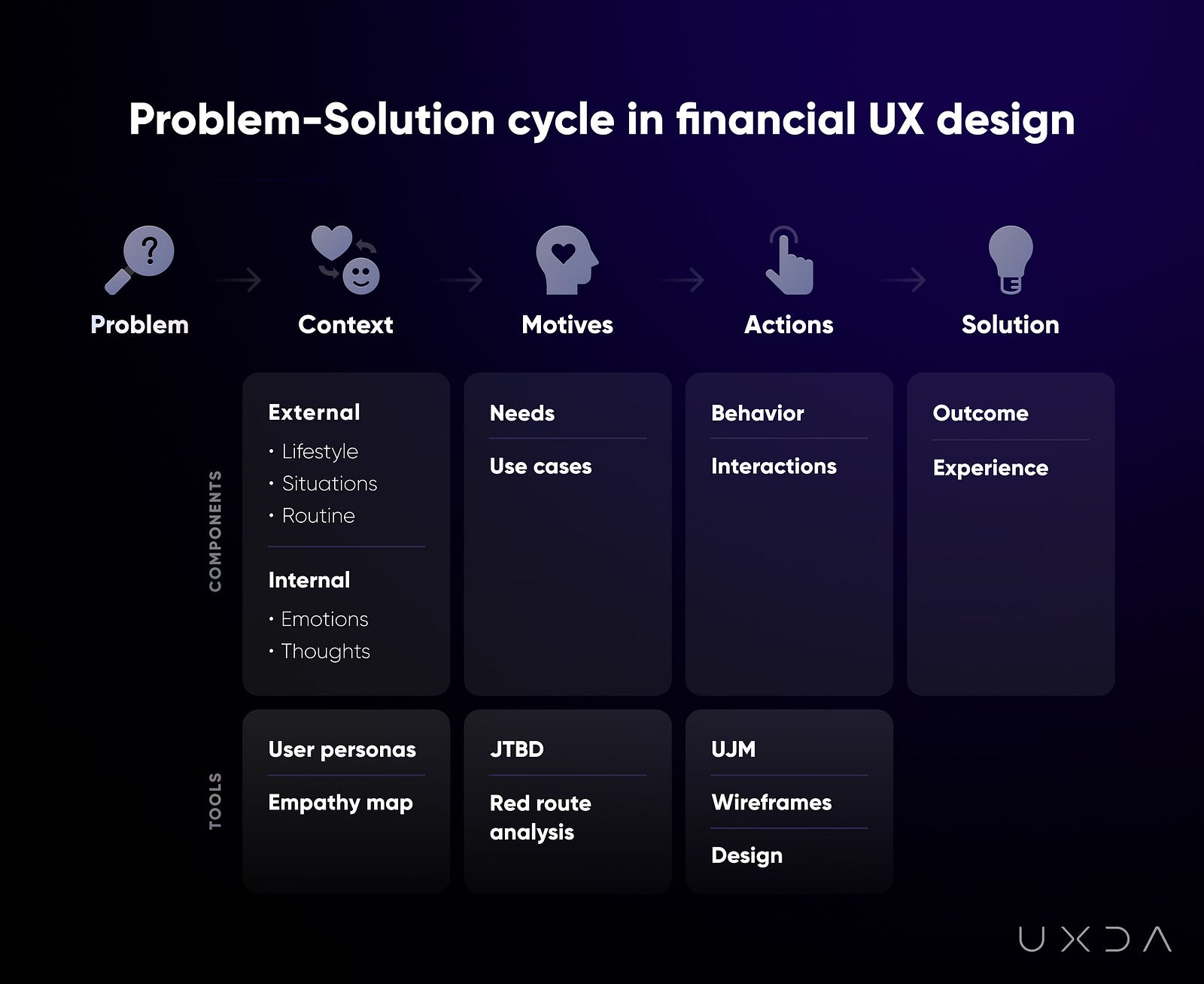

context, motives and actions — three elements that are crucial for truly satisfying the users and solving the problems they are facing.

The success of digital financial services hinges on their ability to simplify users’ lives and address their problems. If a product fails to meet user expectations or needs, they will switch to alternatives that better serve them. Three critical aspects

underscore this dynamic:

- Understanding User Context. Beyond recognizing a user’s problem, developing an effective solution requires a deep dive into the user’s specific context, including their lifestyle, habits, and environment. This involves creating detailed

user profiles and empathy maps to grasp both the external and internal contexts of potential users. Without this comprehensive understanding, a financial service cannot effectively address daily tasks and problems. - Defining Motives. The context shapes users’ motives for seeking a solution, influencing where they look for solutions and how they judge their effectiveness. Utilizing frameworks like Jobs To Be Done (JTBD) and Red Route Analysis helps

identify the true motives behind users’ actions, guiding the development of financial products or services that genuinely meet user needs. - Guiding Actions. Finally, it’s crucial to facilitate the user’s journey towards the solution, ensuring interactions with the product are clear, enjoyable, and effective. This involves employing UX tools like User Journey Maps, wireframes,

and UI design to refine the product experience.

The effectiveness of digital financial services depends on a thorough understanding of user context, clear definition of user motives, and the guidance of user actions towards a satisfying solution.

When you have found out and defined why people will choose your digital financial service in these circumstances, you have to be aware of the proper approach that allows materializing all of this knowledge. This leads us to the second important step of implementing

a purpose-driven strategy in digital banking — the Organization’s Culture.

2. Become Purpose-Driven Disruptor Through Organization’s Culture

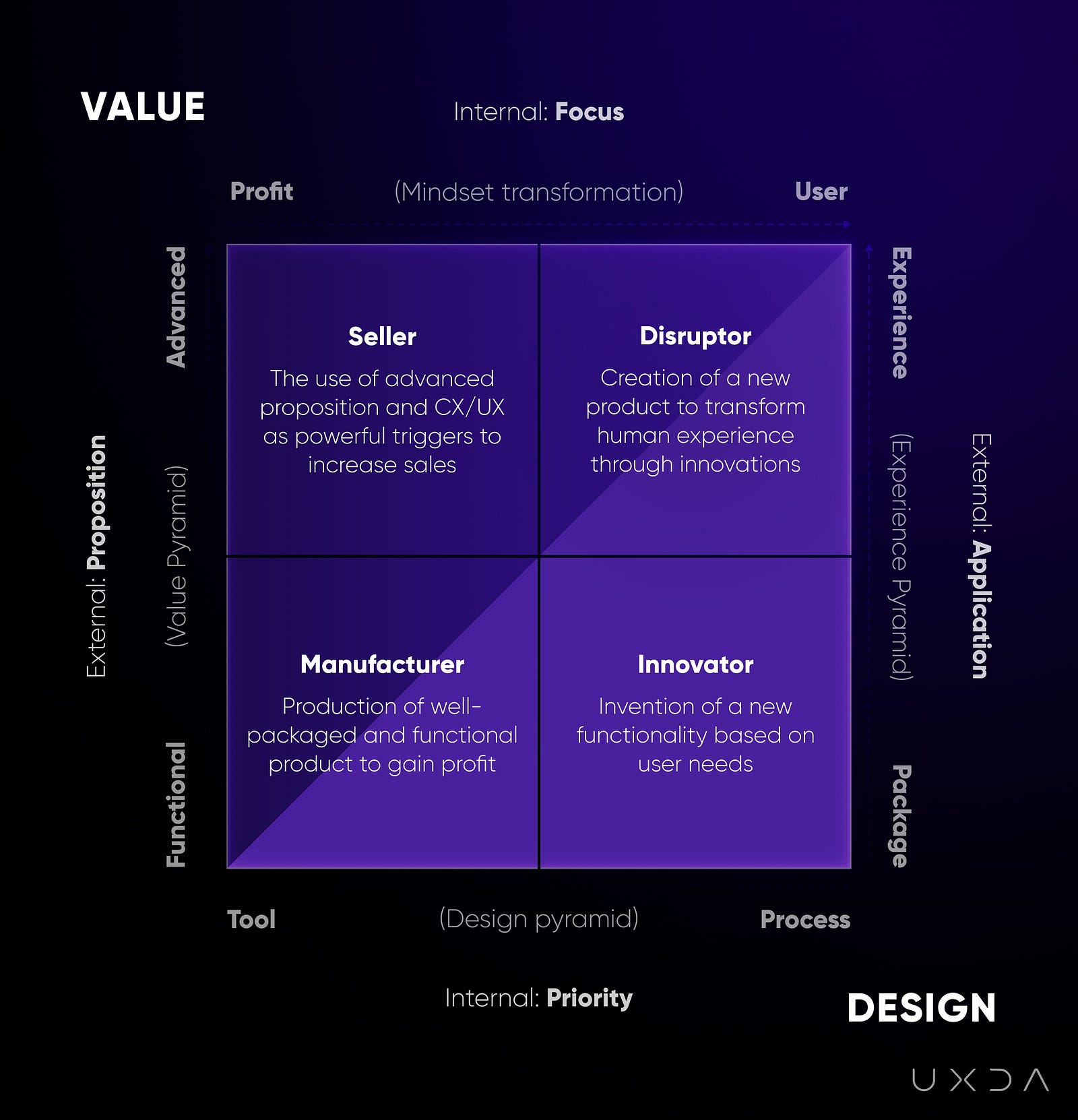

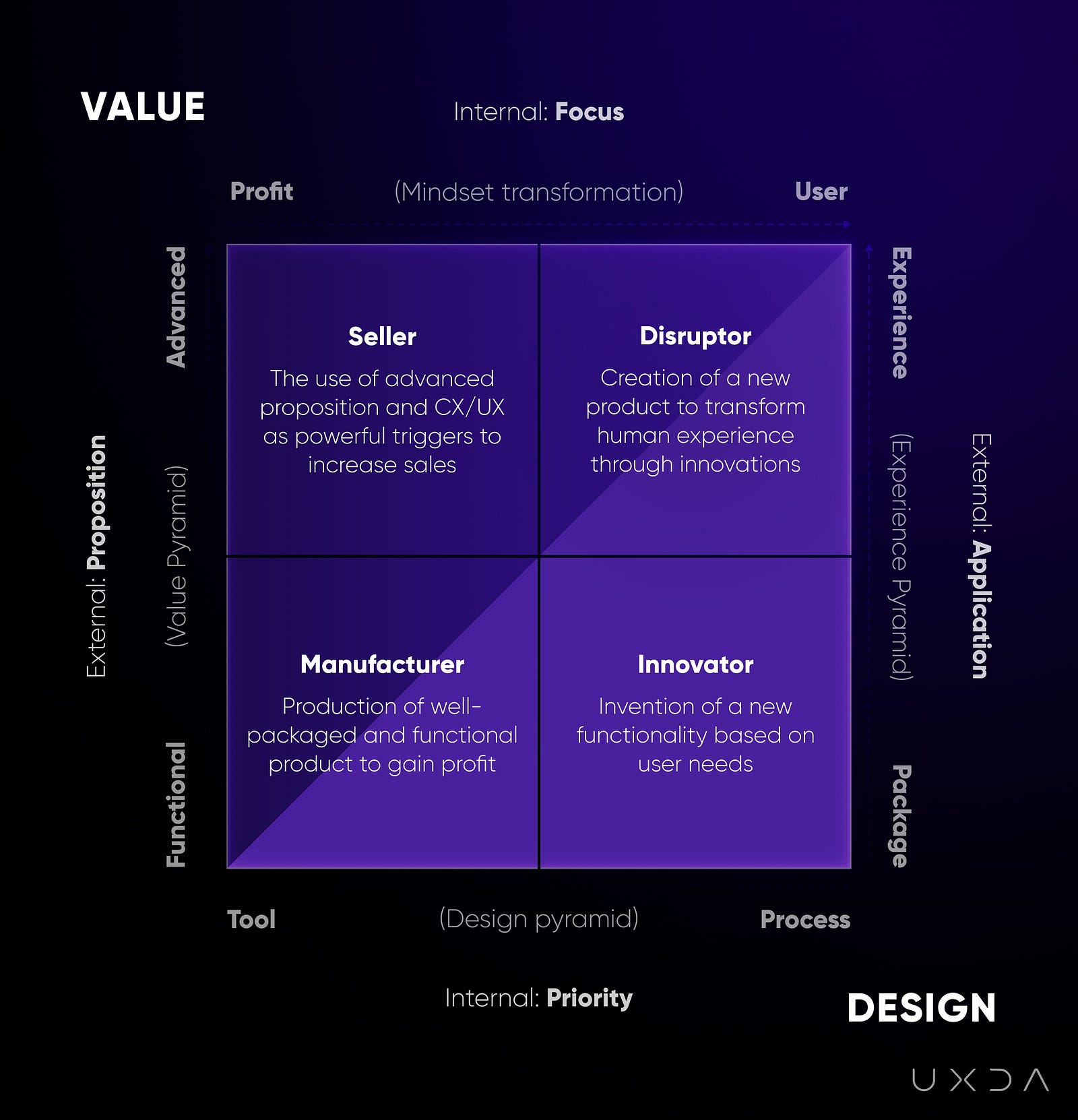

In the digital world, companies that are disruptors have the greatest potential. The secret of their success is the design-matured culture that develops two basic components: Value and Design.

To detect your company’s culture and evolve into a Digital Disruptor, consider the Value/Design Matrix. Disruptors thrive in the digital landscape through a culture emphasizing Value and Design, crucial for shaping the customer experience. We categorize

companies into four types based on their approach to these components:

- Manufacturer. Focuses on production processes over customer needs, viewing design merely as a means to attractive packaging. This model, dominant in the industrial age, neglects consumer interests for basic functionality.

- Seller. Prioritizes promotion, utilizing customer data for emotional marketing strategies. Despite a customer-centric facade, Sellers often fail to genuinely prioritize consumer interests, leading to subpar service.

- Innovator. User-focused, seeking technological advancements to meet consumer needs, often at the expense of neglecting user experience and behavior understanding. Products may appeal to a niche of tech enthusiasts but lack broader usability.

- Disruptor. Integrates all aspects, focusing on customer orientation to reshape markets with innovative services that enhance efficiency and enjoyment. Disruptors use design to perfect the user experience, leveraging Innovators’ functionality

for greater value, achieving long-term success and customer loyalty.

Evolving into a Disruptor involves a deep commitment to customer satisfaction and the strategic use of design and innovation to redefine market standards.

Disruptors see profit as the result of maximum user satisfaction, and as a result of realizing the meaning of the company purpose that is focused on customers’ benefits. This provides them with long-term competitive advantages, customer loyalty and community

support, all of which results in above-average profits.

Disruptors often use the functionality that Innovators have created but develop it at the higher levels of the Value Proposition. Being obsessed with execution, they bring every element of the user experience to perfection. Their task is not so much to create

innovative technologies, but rather to rethink the habitual way of life. And, that is what makes them true Disruptors.

3. Make the Strategy Effective in Terms of Digital Age

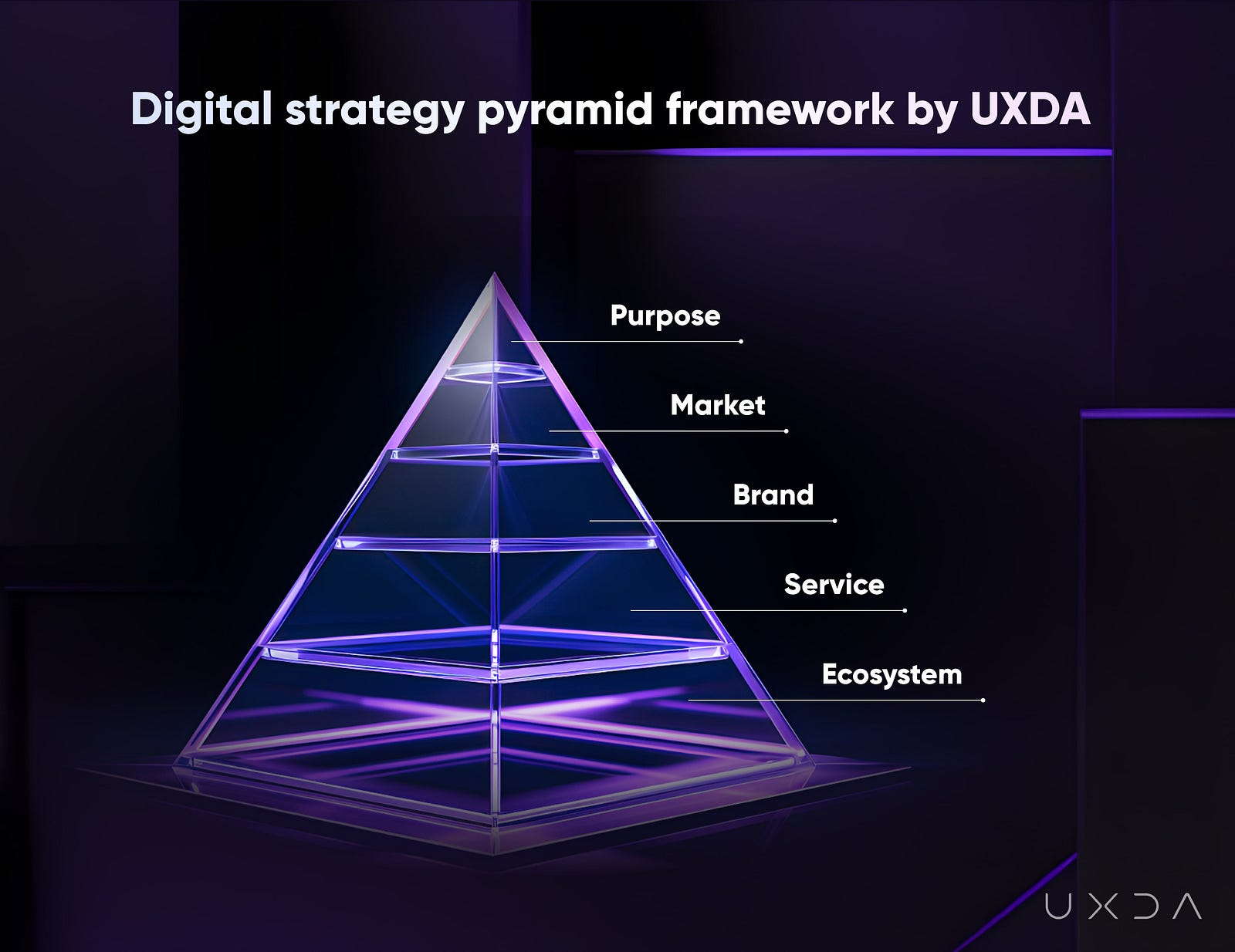

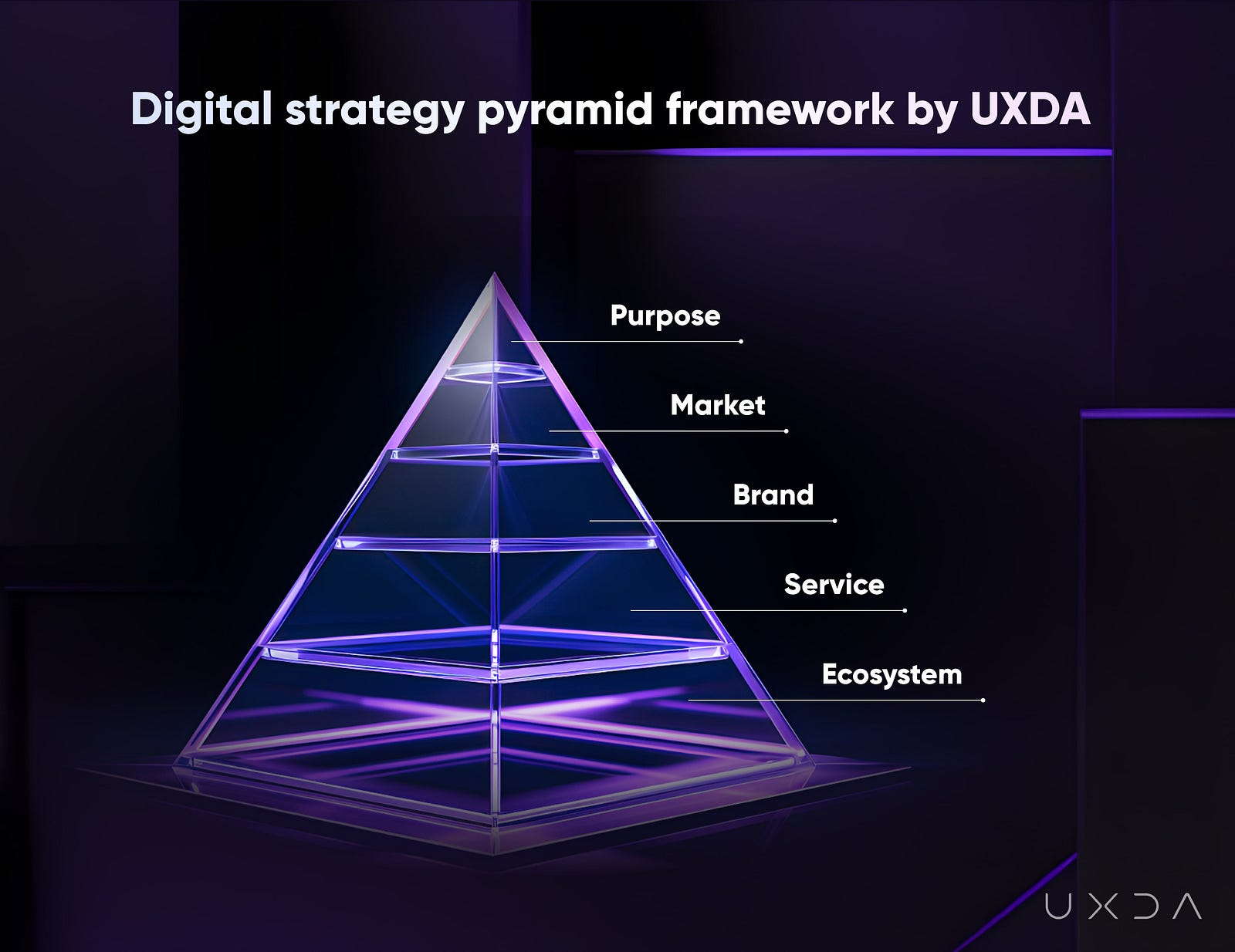

In order to remain competitive in the digital age, modern businesses must adopt a strategic approach to financial product design. In order to facilitate this integration, the Digital Strategy Pyramid framework provides a clear, step-by-step process that

guarantees design choices are in line with the goals of the business, market research, brand identity, service details, and ecosystem coherence.

- Purpose. The foundational level, where a company defines its core “why” — its vision, mission, values, and goals. It’s about creating meaningful impact beyond mere financial gains, focusing on serving a significant cause that benefits customers

and society. For banks, this could mean enhancing financial well-being, providing education, and offering more transparent and value-driven services. - Market. Understanding the target audience, including their needs, expectations, and pain points, is crucial. Banks need to develop digital strategies that resonate with their customers, tailored to address specific requirements and enhance

their financial journey. - Brand. This involves shaping the company’s brand identity and how it communicates authentically with customers. The goal is to reflect the company’s purpose and values in a way that resonates with the target market, ensuring consistency

across all brand experiences to foster loyalty and trust. - Service. Decisions regarding the service offerings are made to fulfill the company’s purpose for its target market, aligned with the brand identity. Positive customer service experiences are key to retention and loyalty, highlighting the

importance of offering a comprehensive range of relevant financial services and products. - Ecosystem. The final level encompasses the digital products and infrastructure that enable customer interaction and service delivery. A cohesive, user-centric digital ecosystem is essential for providing a seamless and frictionless experience

across all touchpoints, which is critical for customer retention and competitive advantage.

4. Implement Design at Every Level of your Organization

As banking digitally transforms, it is critical to navigate the complexities of creating user-centered financial services. Ignoring potential pitfalls can lead to product rejection and lost market advantage, often due to overlooked obstacles and blind spots

by product owners.

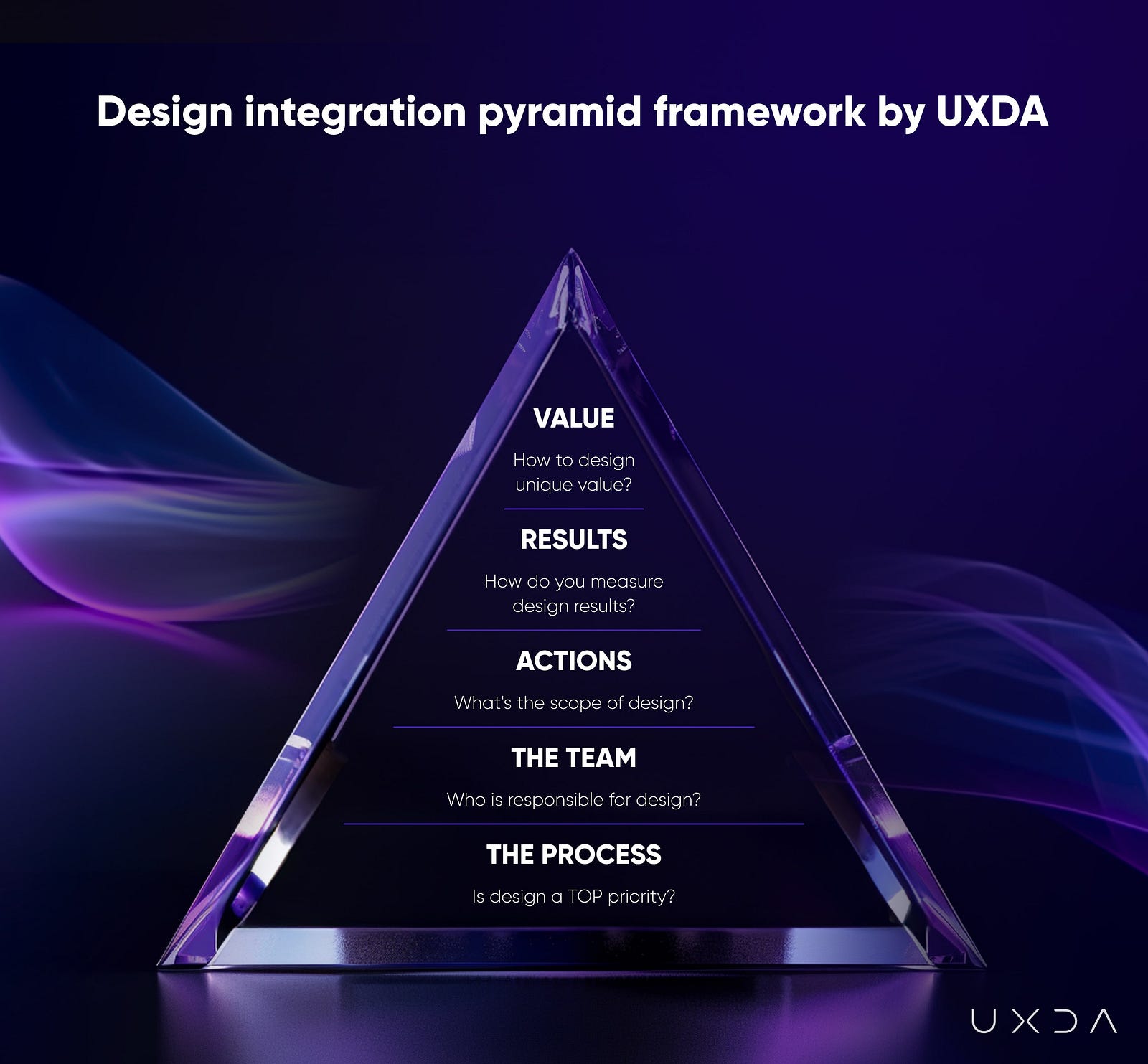

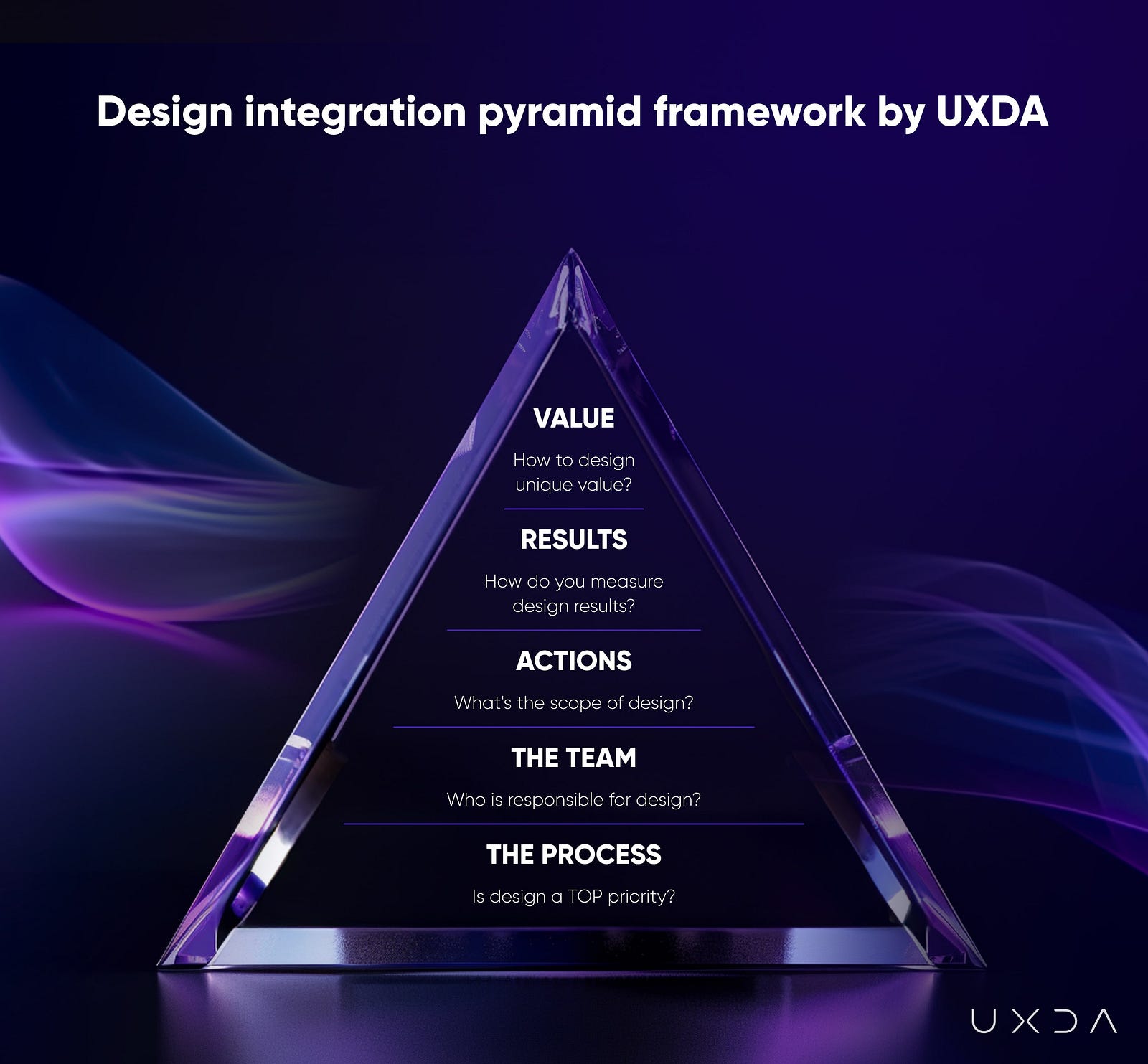

Let’s take five business levels: Process, Team, Action, Results, and Value, each crucial for enhancing design impact within financial organizations. Missteps at any level can jeopardize digital product success.

- First Level: Process. Assess the role of design in company processes. It’s not just about having designers; it’s about integrating design thinking throughout the organization to ensure projects are user-centered, leading to more successful

products. - Second Level: Team. The right team is essential. This includes roles from Chief Experience Officers to UI Designers, each bringing necessary skills to the table. Failure to select competent team members can lead to project failures, as

seen in startups that overlook the importance of financial service design expertise. - Third Level: Action. Design skills must influence beyond superficial elements. Design should act as a unifying force across all departments, emphasizing collaboration over competition to avoid disjointed digital solutions.

- Fourth Level: Results. Success metrics should focus on the value provided to users, not just on deliverables like the number of screens. A user-centered approach requires fewer screens and increases satisfaction, requiring expertise in

analysis, research, and UX architecture. - Fifth Level: Value. The most crucial question is “Why?” Understanding the unique value your product offers ensures innovation and distinguishes it from competitors. Encourage a disruptive mindset within the team to explore outside-the-box

solutions that enhance product value and user benefits.

5. Provide Product Value that has Maximum Market Fit

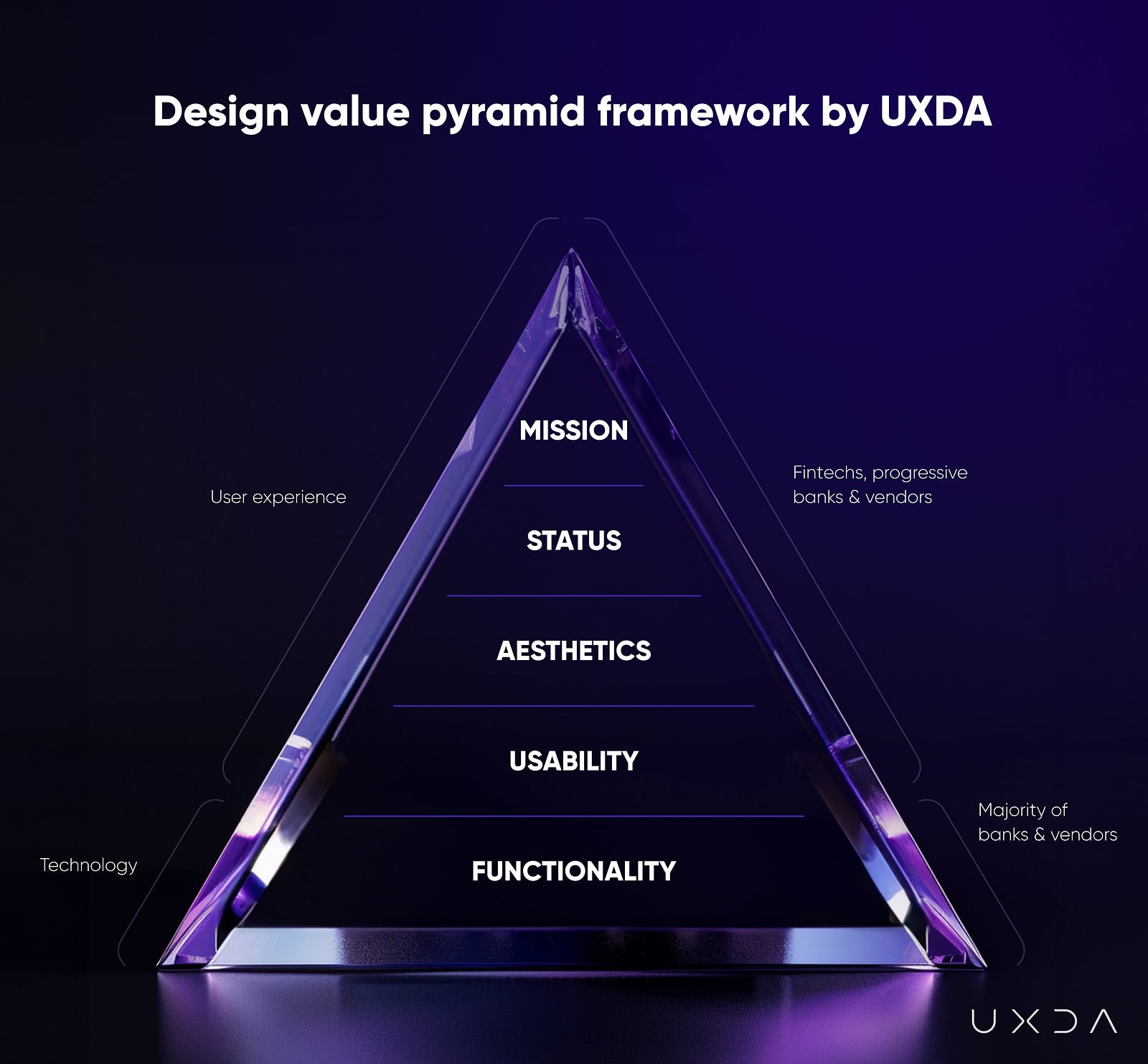

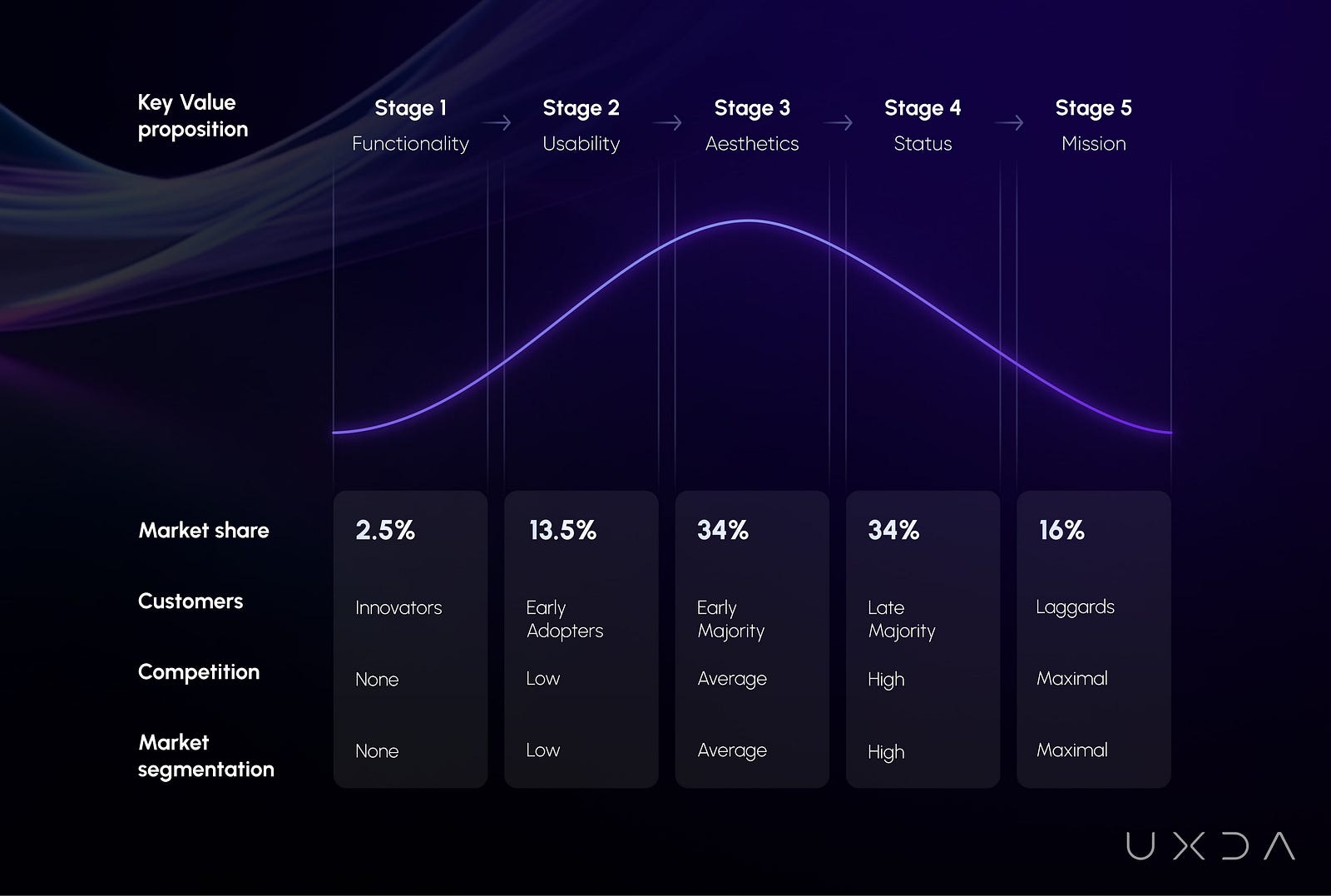

The Value Pyramid draws inspiration from Maslow’s hierarchy, suggesting products evolve to meet higher human needs as competition increases. This evolution makes products more humane, resonating with human nature and desires, especially in the banking sector

where fintech innovation caters to specific user needs more effectively.

- Functional Value. Mirrors physiological needs, focusing on delivering the desired result through product features. This is the basic level where products aim to fulfill the primary function or service they were designed for.

- Usability Value. Aligns with the need for security, emphasizing ease of use to provide users with control and confidence, making the product not just functional but also comfortable to interact with.

- Aesthetics Value. Corresponds to the need for love and belonging, where a product’s design and appearance play a role in attracting users by appealing to their emotions and sense of beauty.

- Status Value. Tied to the need for respect, where the product’s prestige or alignment with a certain lifestyle confers a particular status on its users, making it a symbol of their identity or aspirations.

- Mission Value. Reflects the need for self-actualization, where products or services inspire users to realize their potential or contribute to a larger cause, offering a sense of participation in something significant.

Innovation drives the progression from functionality to mission, with competition pushing products through these stages. Each level of the pyramid not only meets a more sophisticated set of user needs but also competes more effectively in a crowded market.

This progression is evident in industries beyond banking, such as automotive, where products evolve from basic functionality such as T Model by Ford to embodying a mission or ideology that resonates deeply with consumers, such as sustainable Tesla.

As products advance up the market, they must maintain the foundational values of functionality and usability while also embracing aesthetics, status, and ultimately, a mission that aligns with the changing needs and values of society. This holistic approach

to product value development ensures that financial services can remain relevant and impactful in an ever-evolving market landscape.

Conclusion: Digital Transformation in Banking Should Enrich Human Experiences

Digital transformation in banking has evolved from a strategic advantage to a survival necessity, and it is critical to understand that at its core, the transition to next-generation banking and fintech requires more than just finance and technology.

The journey towards digitalization is not merely about adopting cutting-edge technologies or optimizing operational efficiencies; it is about fostering a deep sense of empathy and focusing on design thinking that places the customer at the heart of every

innovation. This evolution is fundamentally about people-about understanding their needs, preferences, and behaviors in a rapidly changing digital landscape.

As banks and other financial institutions navigate through digital transformation, they must embrace a purpose-driven strategy that goes beyond the goal of making a profit at any cost. This strategy should aim to create a positive social impact, promote

financial inclusion, and build a banking experience that is accessible, intuitive, and tailored to meet the diverse needs of the customer base. By doing so, banks can cultivate long-lasting relationships with their customers, grounded in trust, loyalty, and

mutual respect.

Moreover, the focus on empathy and design highlights the importance of understanding the emotional and practical aspects of customer interactions with financial services. It is about creating products and services that are not only technologically advanced

but also deeply resonant with the users’ lives and aspirations. This approach acknowledges that technology should serve as a means to enrich human experiences rather than being an end in itself.

Banks must recognize that their greatest assets are not just their financial products or technological innovations, but the people they serve. By prioritizing empathy and design in their digital transformation strategy, banks can ensure that they are not

just surviving in the digital age but thriving, by creating meaningful, user-centric experiences that align with their customers’ needs and values. In doing so, they will not only secure their place in the future of banking but also contribute to a more inclusive,

accessible, and human-centered financial ecosystem.